For the 24 hours to 23:00 GMT, the EUR declined 0.31% against the USD and closed at 1.2368, after the European Central Bank (ECB) President, Mario Draghi tempered expectations that the central bank could move to normalise its monetary policy before the year-end.

The ECB Chief stated that policymakers await to see further evidence of inflation dynamics moving in the right direction in order to end the central bank’s expansionary monetary policies.

On the economic front, Euro-zone’s seasonally adjusted industrial production retreated more-than-anticipated by 1.0% on a monthly basis in January, dropping for the first time in 4 months and compared to market expectations for a fall of 0.5%. In the previous month, industrial production had advanced 0.4%.

Separately, Germany’s final consumer price index (CPI) climbed 1.4% in February, meeting the preliminary print. In the prior month, the CPI had registered a rise of 1.6%.

The US Dollar declined against a basket of major currencies, amid rising trade war fears and after an unexpected drop in US retail sales intensified concerns that Americans would continue to keep a tight grip on spending.

Data indicated that advance retail sales registered an unexpected drop of 0.1% on a monthly basis in February, declining for the third straight month and compared to a revised similar fall in the previous month. Market participants had expected advance retail sales to gain 0.3%.

On the other hand, the nation’s producer price index (PPI) grew 2.8% on a yearly basis in February, meeting market expectations. In the previous month, the PPI had risen 2.7%.

In other economic news, business inventories in the US advanced 0.6% on a monthly basis in January, meeting market expectations and following a revised similar rise in the previous month. Further, the nation’s MBA mortgage applications gained 0.9% in the week ended 09 March, after recording a rise of 0.3% in the prior week.

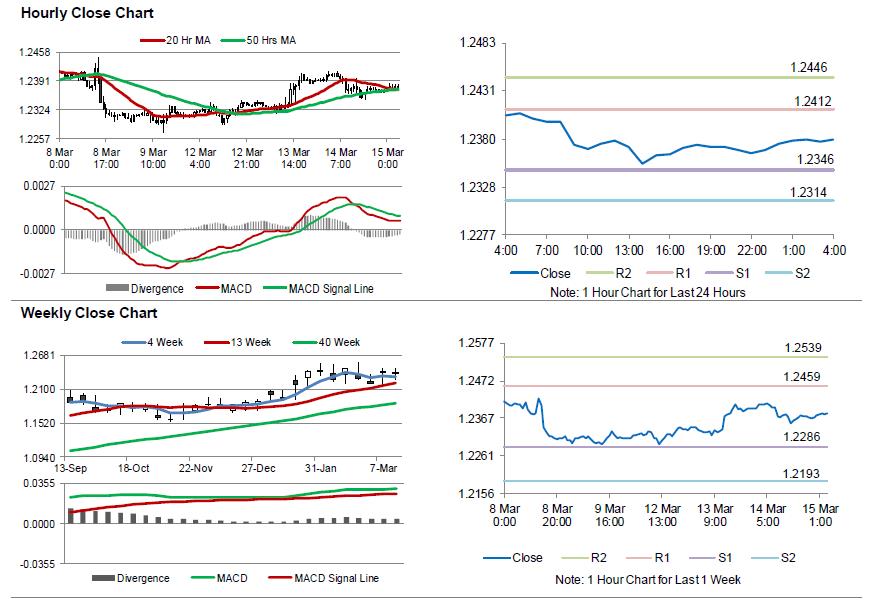

In the Asian session, at GMT0400, the pair is trading at 1.2379, with the EUR trading 0.09% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2346, and a fall through could take it to the next support level of 1.2314. The pair is expected to find its first resistance at 1.2412, and a rise through could take it to the next resistance level of 1.2446.

Amid a lack of key macroeconomic releases in the Euro-bloc today, investors would look forward to the US initial jobless claims followed by the Philadelphia Fed manufacturing survey and the NAHB housing market index, both for March, slated to release later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.