On Friday, EUR rose 0.75% against the USD and closed at 1.3809, as traders reacted positively to the Euro-zone’s consumer inflation data, which showed that the consumer price index rose 0.8% (YoY) in February, similar to the pace of rise in the previous month but more than analysts’ expectations for a rise of 0.7%. Another report showed that unemployment rate in the region stood pat at previous month’s level of 12%, broadly in-line with market expectations. Positive sentiment for the Euro-zone common currency was also fuelled after German retail sales rose at the fastest pace in seven years in January and after Moody’s Investors Service upgraded its credit rating outlook on Germany’s “Aaa” rating to “Stable” from “Negative.”

Meanwhile, the US Dollar came under pressure after preliminary reading of the nation’s annualised GDP came in at 2.4% in the fourth-quarter, less than analysts’ call for a 2.5% rise and compared to a 3.2% increase registered in the preceding quarter. However, the losses in the greenback were limited after the Fed Philadelphia President, Charles Plosser, downplayed the dismal GDP report and projected a 3% growth in the economy this year. Furthermore, he hinted at a hike in the nation’s benchmark interest rate very soon, citing traditional models of monetary policy. Separately, the Dallas Fed President, Richard Fisher suggested the US Fed to “stop large scale asset purchases entirely” as soon as feasible, adding that a continuation in purchases could complicate future monetary policy. Meanwhile, the St. Louis Fed President, James Bullard, advised that the weakness in the recent economic data, as a result of a bad weather, should not dampen optimism of the recovery of the economy for the rest of the year.

On the economic front, in the US, the Reuters/Michigan consumer sentiment index rose more-than-expected to a level of 81.6 in February, from a reading of 81.2 registered in the previous month. Likewise, the Chicago purchasing managers’ index edged up to a level of 59.8 in February, from a figure of 59.6 recorded in the preceding month. However, pending home sales in the nation missed analysts’ estimates and rose 0.1% (MoM) in January, rebounding from a 5.8% drop witnessed in December.

In the Asian session, at GMT0400, the pair is trading at 1.3780, with the EUR trading 0.21% lower from Friday’s close.

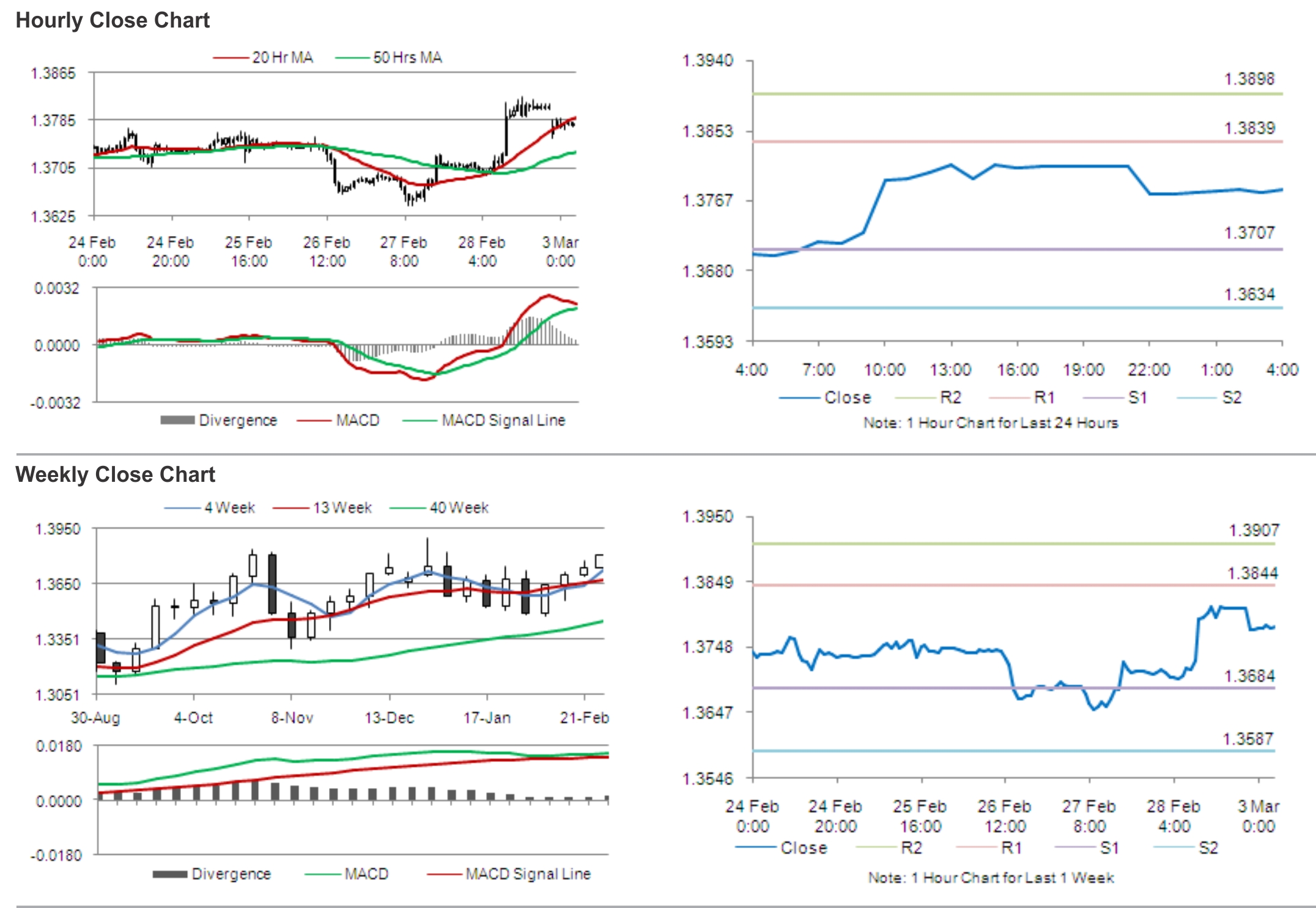

The pair is expected to find support at 1.3707, and a fall through could take it to the next support level of 1.3634. The pair is expected to find its first resistance at 1.3839, and a rise through could take it to the next resistance level of 1.3898.

Traders await the Euro-zone’s Markit manufacturing PMI data and the European Central Bank (ECB) President, Mario Draghi’s speech, due later today.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.