On Friday, EUR rose 0.15% against the USD and closed at 1.2668, after Germany’s GfK consumer confidence index unexpectedly climbed to a level of 8.5 in November, compared to a revised level of 8.4 registered in the previous month, while markets were expecting it to fall to a reading of 8.0.

Elsewhere, in Italy, retail sales declined 0.1% on a monthly basis in August, matching market expectations, while Spain’s producer price index advanced 0.5% on MoM basis in September, compared to a drop of 0.1% recorded in August.

On Friday, the ECB Chief, Mario Draghi urged the Euro-zone nations to undertake more structural economic reforms in order to avert “a relapse into recession”.

In the US, new home sales surprisingly rose to a 6-year high of 0.2% on a monthly basis in September, beating market expectations for a drop of 6.8% and compared to an increase of 15.3% registered in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.2706, with the EUR trading 0.3% higher from Friday’s close.

Over the weekend, the ECB in its yearlong audit of 150 Euro-zone banks reported that most of the region’s biggest banks have enough capital and would be able to stand another financial slowdown. However, 25 Euro-zone banks failed the central bank’s stress test, facing a cumulative shortfall of €24.6 billion.

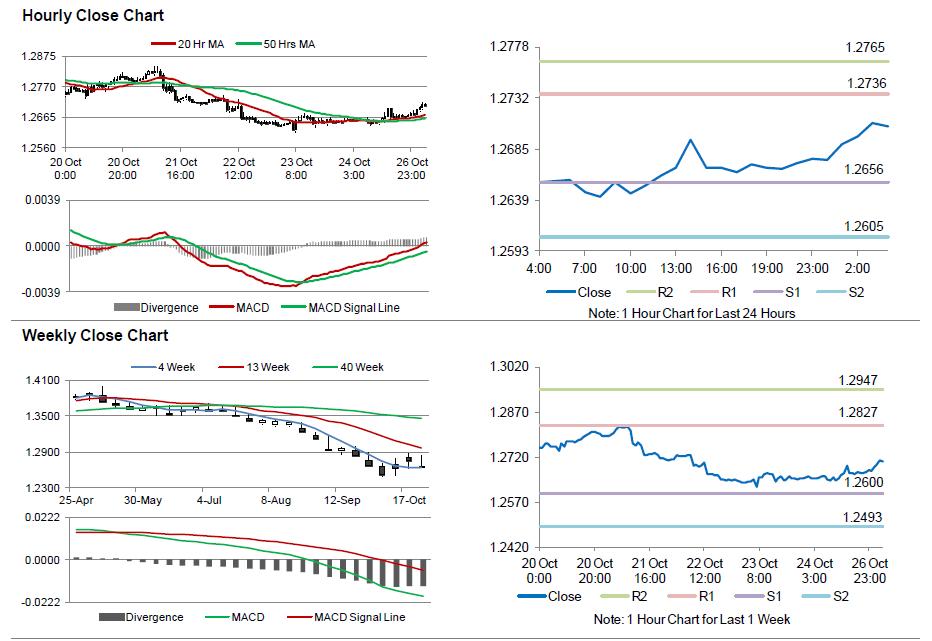

The pair is expected to find support at 1.2656, and a fall through could take it to the next support level of 1.2605. The pair is expected to find its first resistance at 1.2736, and a rise through could take it to the next resistance level of 1.2765.

Trading trends in the Euro today are expected to be determined by the ECB’s announcement on buying corporate bonds as well as Germany’s economic expectation data, scheduled later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.