For the 24 hours to 23:00 GMT, EUR rose 0.15% against the USD and closed at 1.3794, as traders cheered the latest batch of upbeat economic data across the Euro-zone.

Data showed that Euro-zone unemployment rate stood pat at previous month’s level of 11.9% in February, defying analysts’ expectations for a rise to 12.0%. Another report confirmed that the Markit manufacturing PMI for the Euro-zone came in at a reading of 53.0 in March, at par with flash estimates but down compared to previous month’s level of 53.2. Meanwhile, data from Germany showed that unemployment in fell more-than-expected by 12,000 during March while the unemployment rate unexpectedly remained unchanged at previous month’s level of 6.7%. Separately, the Markit manufacturing PMI for Spain rose to a 47-month high reading of 52.8 last month while Italy’s and France’s Markit manufacturing PMI also surpassed market expectation for March. However, Germany’s Markit manufacturing PMI surprisingly fell to a reading of 53.7 in March while unemployment rate in Italy unexpectedly inched up to 13.0% in February.

Positive sentiment for the Euro was also fuelled after the ECB Vice President, Vitor Constancio projected inflation rate in the region to bounce back in April, following a fall to 0.5% in March. Furthermore, he indicated that he did not see deflation prospects in the Euro-zone but at the same time warned that the economy could face a protracted period of low inflation, which could act as a drag on the region’s economic recovery. However, EU’s Olli Rehn highlighted concerns on the possible impact of a prolonged period of low inflation in the region as, according to him, it could “negatively affect the rebalancing process of the Euro-zone economy.”

In the US, the ISM manufacturing PMI advanced to a reading of 53.7 in March, less than economists’ estimates for a rise to 54.0 and compared to a level of 53.2 registered in the preceding month. Separately, Markit Economics reported that its manufacturing PMI fell to a reading of 55.5 in March, from a final reading of 57.1 in February.

In the Asian session, at GMT0300, the pair is trading at 1.3802, with the EUR trading 0.06% higher from yesterday’s close.

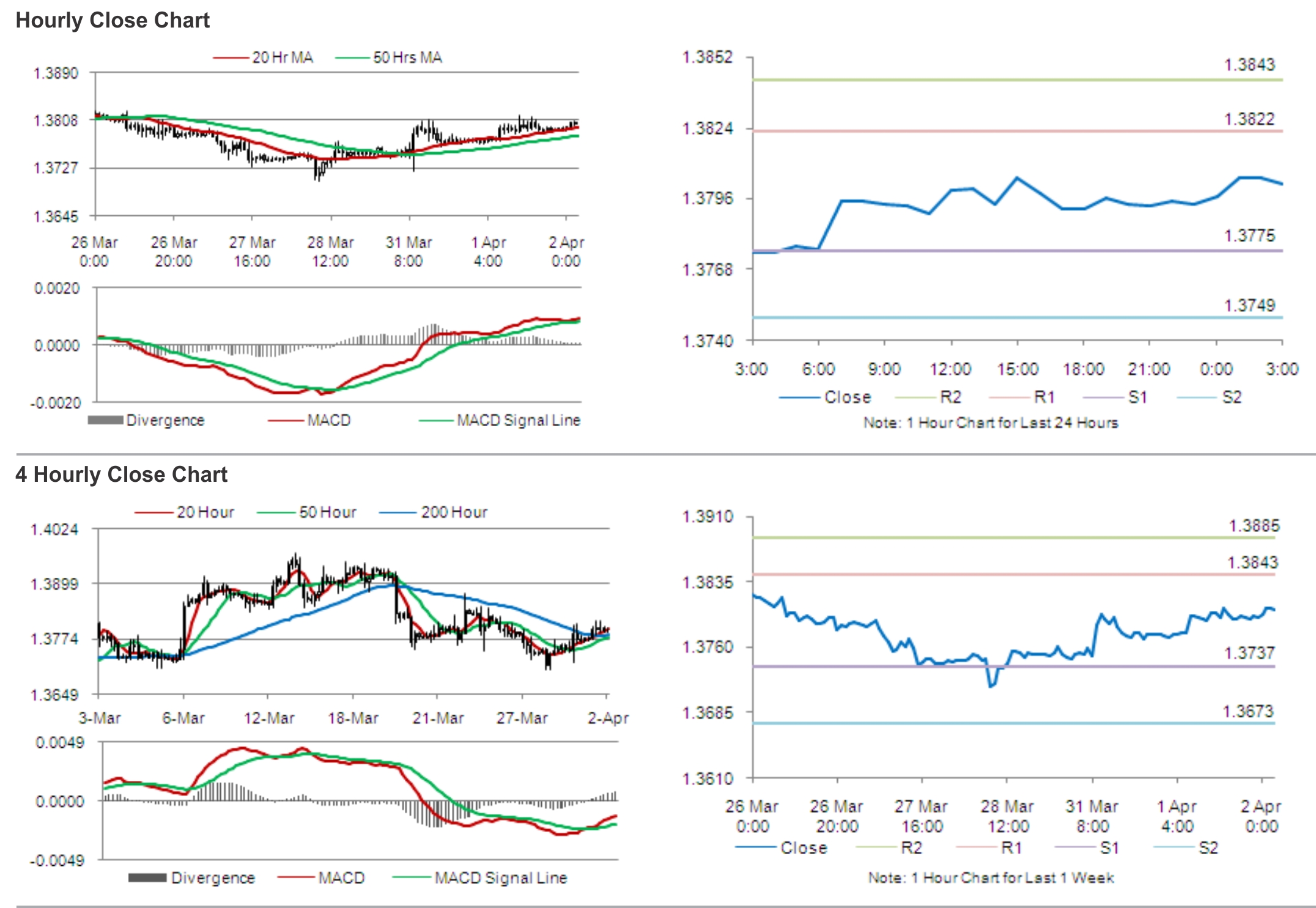

The pair is expected to find support at 1.3775, and a fall through could take it to the next support level of 1.3749. The pair is expected to find its first resistance at 1.3822, and a rise through could take it to the next resistance level of 1.3843.

Market participants keenly await Euro-zone’s GDP data for further cues in the Euro.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.