For the 24 hours to 23:00 GMT, the EUR slightly declined against the USD and closed at 1.0761.

Yesterday, the European Central Bank (ECB), in its economic bulletin report, stated that headline inflation has increased recently, largely attributed to a spike in energy prices, but underlying inflation pressures remain subdued.

In other economic news, the Euro-zone’s producer price index (PPI) rose more-than-expected by 0.7% MoM in December, driven by soaring energy costs, compared to market expectations for a rise of 0.5% and following a gain of 0.3% in the previous month.

In the US, data showed that the number of Americans filing for fresh jobless claims dropped higher-than-expected to a level of 246.0K in the week ended 28 January 2017, pointing towards a tighter labour market. Markets were expecting initial jobless claims to ease to a level of 250.0K and after recording a revised reading of 260.0K in the prior week.

In the Asian session, at GMT0400, the pair is trading at 1.0753, with the EUR trading 0.07% lower against the USD from yesterday’s close.

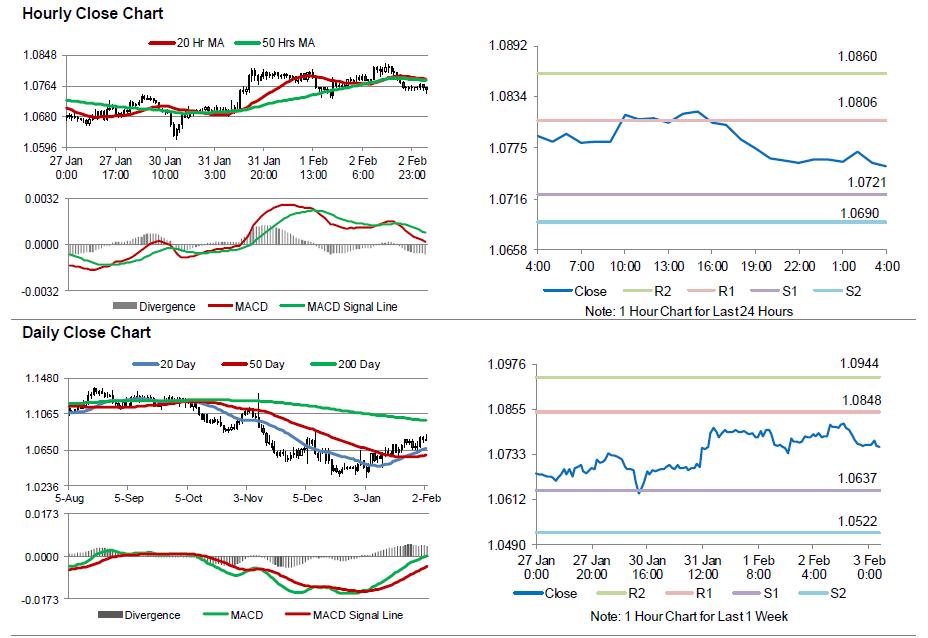

The pair is expected to find support at 1.0721, and a fall through could take it to the next support level of 1.0690. The pair is expected to find its first resistance at 1.0806, and a rise through could take it to the next resistance level of 1.0860.

Ahead in the day, traders would closely monitor the release of final Markit services PMI for January, across the Euro-zone along with the Euro-zone’s retail sales data for December. Additionally, investors will anxiously await crucial releases in the US, consisting of non-farm payrolls, unemployment rate, Markit services PMI, ISM non-manufacturing PMI, all for January accompanied with factory orders and final durable goods orders, both for December, all scheduled to release later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.