For the 24 hours to 23:00 GMT, the EUR rose 0.14% against the USD and closed at 1.1386, amid renewed optimism for a negotiation over Italy’s budget.

The Organisation for Economic Cooperation and Development (OECD), its latest Economic Outlook report, warned that persistent trade tensions and higher interest rates are slowing the global economic growth. As a result, the OECD cut its global growth forecast for 2019 to 3.5% from 3.7% projected in May. Moreover, the global economy was forecast to expand 3.5% in 2020, while outlook for the current year remained unchanged at 3.7%. Further, the OECD warned that slowdown in Chinese growth would damage global growth significantly. Additionally, the OECD slashed Euro-zone’s growth forecasts for this year and next year to 1.9% and 1.8%, respectively, and is expected to ease further to 1.6% in 2020.

In the US, data showed that the US final Reuters/Michigan consumer sentiment index slid to a 3-month low level of 97.5 in November, overshooting market consensus for a drop to a level of 98.3. The index had recorded a level of 98.6 in the previous month, while preliminary figures had registered a fall to a level of 98.3. Moreover, preliminary durable goods orders retreated 4.4% on a monthly basis in October, compared to a revised fall of 0.1% in the previous month. Market participants had envisaged durable goods orders to decline by 2.6%. Also, the MBA mortgage applications declined 0.1% on a weekly basis in the week ended 16 November 2018. In the previous week, mortgage applications had recorded a decrease of 3.2%. Additionally, the nation’s seasonally adjusted initial jobless claims unexpectedly advanced to a four-month high level of 224.0K in the week ended 17 November 2018, defying market expectations for a fall to a level of 215.0K. Initial jobless claims had recorded a revised reading of 221.0K in the prior week.

On the contrary, the nation’s existing home sales rebounded 1.4% on monthly basis, to a level of 5.22 million in October, more than market expectations for a rise to a level of 5.20 million. Existing home sales had recorded a reading of 5.15 million in the prior month. Meanwhile, the US leading indicator rose 0.1% on a monthly basis in October, in line with market expectations and following a revised rise of 0.6% in the preceding month.

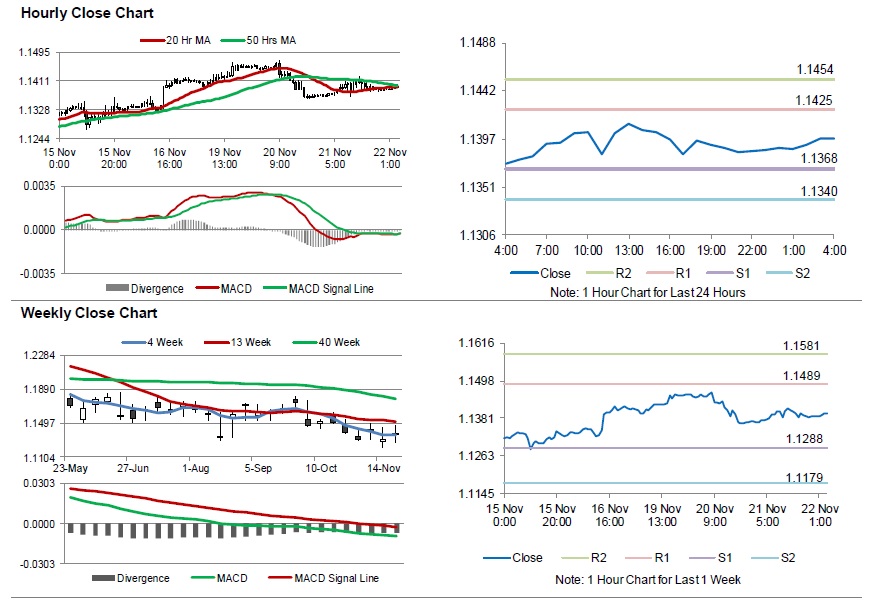

In the Asian session, at GMT0400, the pair is trading at 1.1397, with the EUR trading 0.10% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1368, and a fall through could take it to the next support level of 1.1340. The pair is expected to find its first resistance at 1.1425, and a rise through could take it to the next resistance level of 1.1454.

Moving forward, traders would keep an eye on the Euro-zone’s consumer confidence index for November, set to release in a few hours.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.