For the 24 hours to 23:00 GMT, the EUR declined 0.14% against the USD and closed at 1.1062.

On the data front, Euro-zone’s flash consumer confidence index advanced to a level of -7.2 in November, more than market expectations for a rise to a level of -7.3. In the previous month, the index had registered a level of -7.6.

The Organization for Economic Cooperation and Development (OECD), in its Economic Outlook projected the global economy to expand at its weakest pace in a decade, trimming its global economic growth forecast to 2.9% from 3.0% in 2020. However, OECD expects the global economy to improve to 3.0% in 2021. On the contrary, Euro-zone’s economy is projected to improve to 1.1% in 2020 and 1.2% in 2021. Meanwhile, the organisation projected the US economic growth to slow down to 2.0% in 2020 and 2021 from an estimated 2.3% in 2019.

In the US, data showed that the existing home sales rose of 1.9% on monthly basis, to a level of 5.46 million in October, less than market expectations for a rise to a level of 5.47 million. Existing home sales had registered a revised reading of 5.36 million in the previous month. Meanwhile, the US seasonally adjusted initial jobless claims remained unchanged at a 5-year high level of 227.0K in the week ended 15 November 2019, defying market consensus for a drop to a level of 219.0K. On the other hand, the Philadelphia Fed manufacturing index advanced to 10.4 in November, more than market consensus and compared to a level of 5.6 in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.1064, with the EUR trading a tad higher against the USD from yesterday’s close.

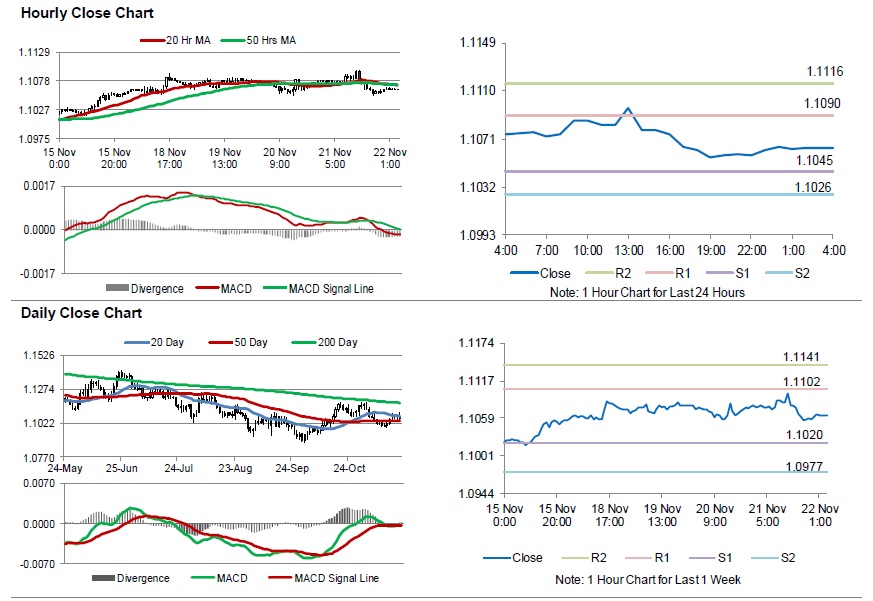

The pair is expected to find support at 1.1045, and a fall through could take it to the next support level of 1.1026. The pair is expected to find its first resistance at 1.1090, and a rise through could take it to the next resistance level of 1.1116.

Looking ahead, traders would await Germany’s gross domestic product for 3Q 2019 along with the Markit manufacturing and services PMIs, both for November, set to release across the euro bloc. Later in the day, the US Markit manufacturing and services PMIs followed by the Michigan consumer sentiment index, all for November will keep traders on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.