For the 24 hours to 23:00 GMT, the EUR rose 0.12% against the USD and closed at 1.3621.

Yesterday, the ECB Chief, Mario Draghi expressed concerns over a stronger Euro and urged that it would hurt the recovery process in the Euro-zone. Further, he reiterated his earlier stance that the exchange rate would not play an important role in deciding any future monetary policy, however the central bank would closely keep an eye on the effects of any appreciation of the Euro because that would affect the inflation rate. He asserted that large-scale purchases of public and private debt fell under the ECB’s mandate, which could be undertaken to keep inflation low and stable while adding that all policymakers unanimously support the unconventional measures of the ECB.

Meanwhile, the IMF called for the ECB to seriously consider QE, in order to stimulate lending in the region and keep ultralow inflation from damaging the bloc’s recovery. The fund slashed its projections for the economic growth of the Euro-zone this year and cautioned that any further appreciation of the common currency might push the region into deflationary territory.

In economic news, industrial production in the Euro-zone dropped 1.1% (MoM) in May, erasing its earlier month’s rise of 0.7%.

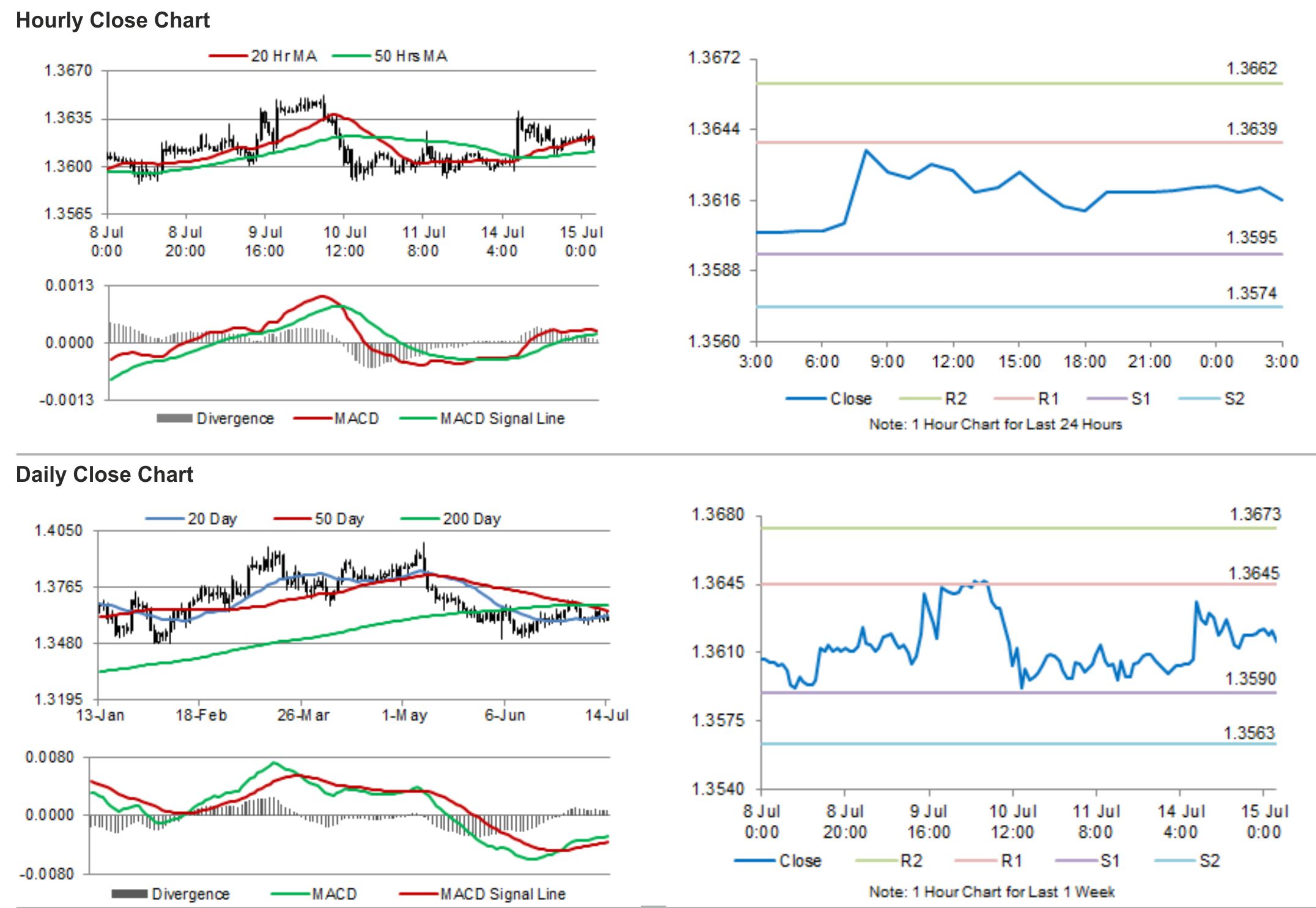

In the Asian session, at GMT0300, the pair is trading at 1.3616, with the EUR trading tad lower from yesterday’s close.

The pair is expected to find support at 1.3595, and a fall through could take it to the next support level of 1.3574. The pair is expected to find its first resistance at 1.3639, and a rise through could take it to the next resistance level of 1.3662.

Traders would keenly await ZEW survey indices data from the Euro-zone and Germany to get cues about the economic outlook of the region.

The currency pair is trading above its 20 Hr moving average and is showing convergence with its 50 Hr moving averages.