For the 24 hours to 23:00 GMT, EUR declined 0.28% against the USD and closed at 1.3736, as traders refrained from taking major bets in the risk-on, Euro, amid ongoing tensions in Ukraine. Negative sentiment for the Euro-bloc common currency was also fuelled after the IMF Chief, Christine Lagarde indicated that she sees 15-20% risk of extended low inflation in the Euro-zone. Furthermore, she warned that prolonged low level of inflation could risk derailing the region’s fragile economic recovery, suggesting the ECB to undertake additional stimulus measures in order to combat such risks.

Meanwhile, the ECB President, Mario Draghi acknowledged that persistent low level of inflation in the Euro-zone could pose a risk to inflation expectations. He further stated that inflation expectations in the economy remains in line with the central bank’s definition of price stability.

In economic news, Markit manufacturing PMI in the Euro-zone declined to a reading of 53.2 in February, less than market expectations for a fall to a figure of 53.0, from previous month’s level of 54.0. Likewise, Germany’s Markit manufacturing PMI also registered a less-than-expected drop in February while Markit’s manufacturing PMI in France posted a surprise rise in the previous month.

Meanwhile, the US Dollar advanced against the Euro after the US ISM manufacturing PMI posted an upbeat rise to a level of 53.2 in February, from a reading of 51.3 registered in January. Similarly, Markit Economics reported that activities in the US manufacturing sector rose more than analysts’ expectation to its highest level since May 2010 in February.

In the Asian session, at GMT0400, the pair is trading at 1.3733, with the EUR trading tad lower from yesterday’s close.

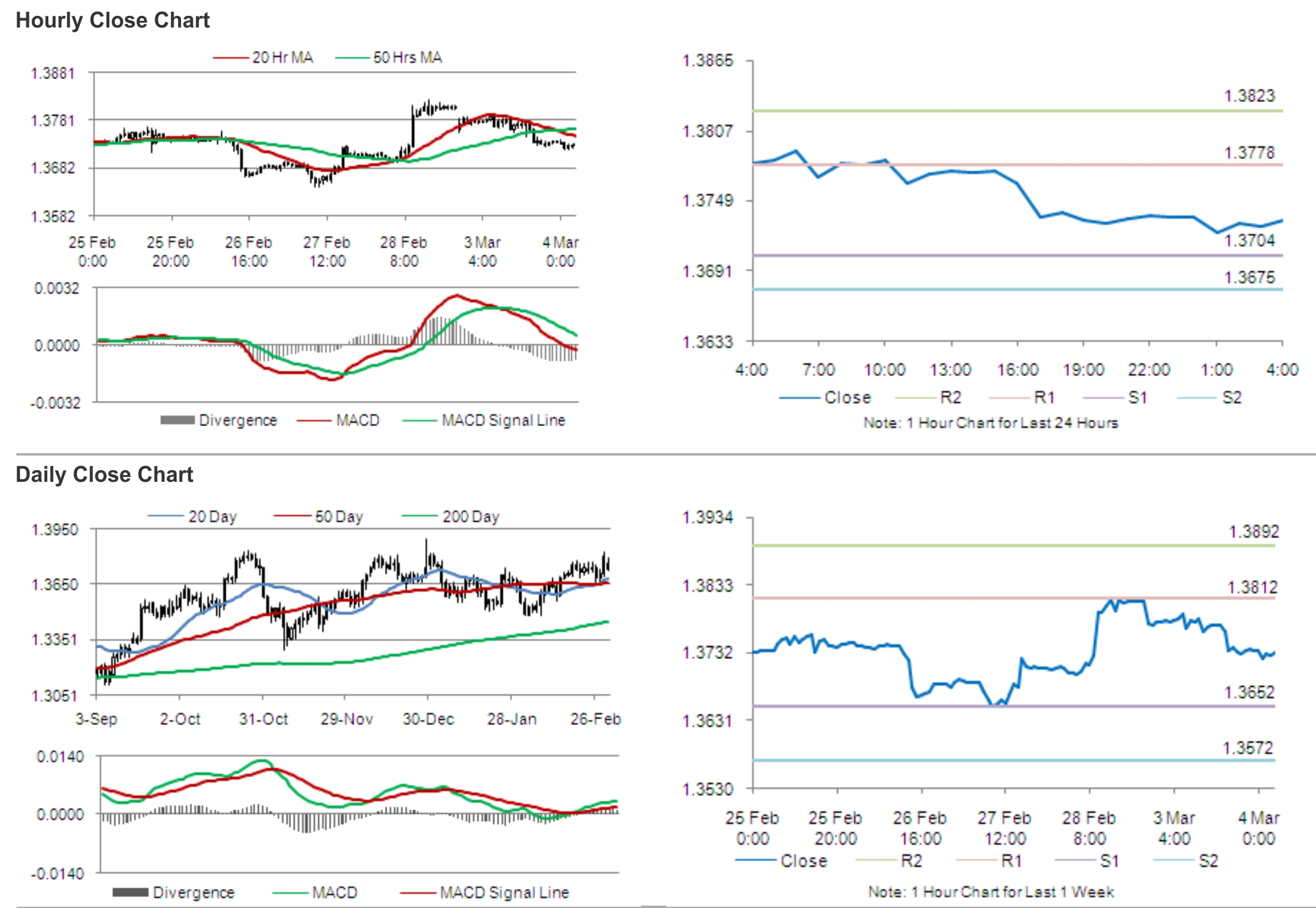

The pair is expected to find support at 1.3704, and a fall through could take it to the next support level of 1.3675. The pair is expected to find its first resistance at 1.3778, and a rise through could take it to the next resistance level of 1.3823.

Later today, the Eurostat is expected report the trend in Euro-zone’s producer price index for January.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.