On Friday, EUR declined 0.12% against the USD and closed at 1.3593. The US Dollar traded on a higher footing, amid increasing speculation that the minutes of the Fed’s latest monetary policy meeting to be released later during the week, would highlight the timing of a rise in the nation’s key interest rates. Meanwhile, the greenback was further boosted during the weekend after the IMF Chief, despite hinting a slash in the global rate forecast, stated that the economic recovery in the US would eventually gain momentum. Additionally, she added that the Euro-zone is gradually emerging out of recession and would continue to do if the countries in the bloc implement necessary reforms, including the formation of a banking union.

On the economic front, in the Euro-zone, factory orders in Germany on a monthly basis fell sharply in May, after showing a considerable improvement in the previous month. The orders were 1.7% lower in May, compared to a 3.4% rise in the previous month.

Meanwhile, ECB’s policymaker Christian Noyer on Sunday in an economic conference in France stated that the government of the various countries on the bloc are making no attempts to reduce their deficit. He further added that outright deflation has been avoided as present, even if the rate of price increase in the region remains “too low”.

The ECB Executive Board member, Benoit Coeure urged that the interest rates in the regions would remain “very close to zero” for a prolonged period, irrespective of economic developments on the global front. He expressed concerns on the health of the Euro-zone’s economy and stated that the current economic situation is very worrying, and the region can only recover by decreasing sovereign debt and increasing its level of investment.

Another ECB Executive Board member, Sabine Lautenschlaeger, indicated that she does not see the central bank indulging in the purchase of government bonds in the near future, and doing so would only be viable on extraordinary risks.

In the Asian session, at GMT0300, the pair is trading at 1.3585, with the EUR trading 0.06% lower from Friday’s close.

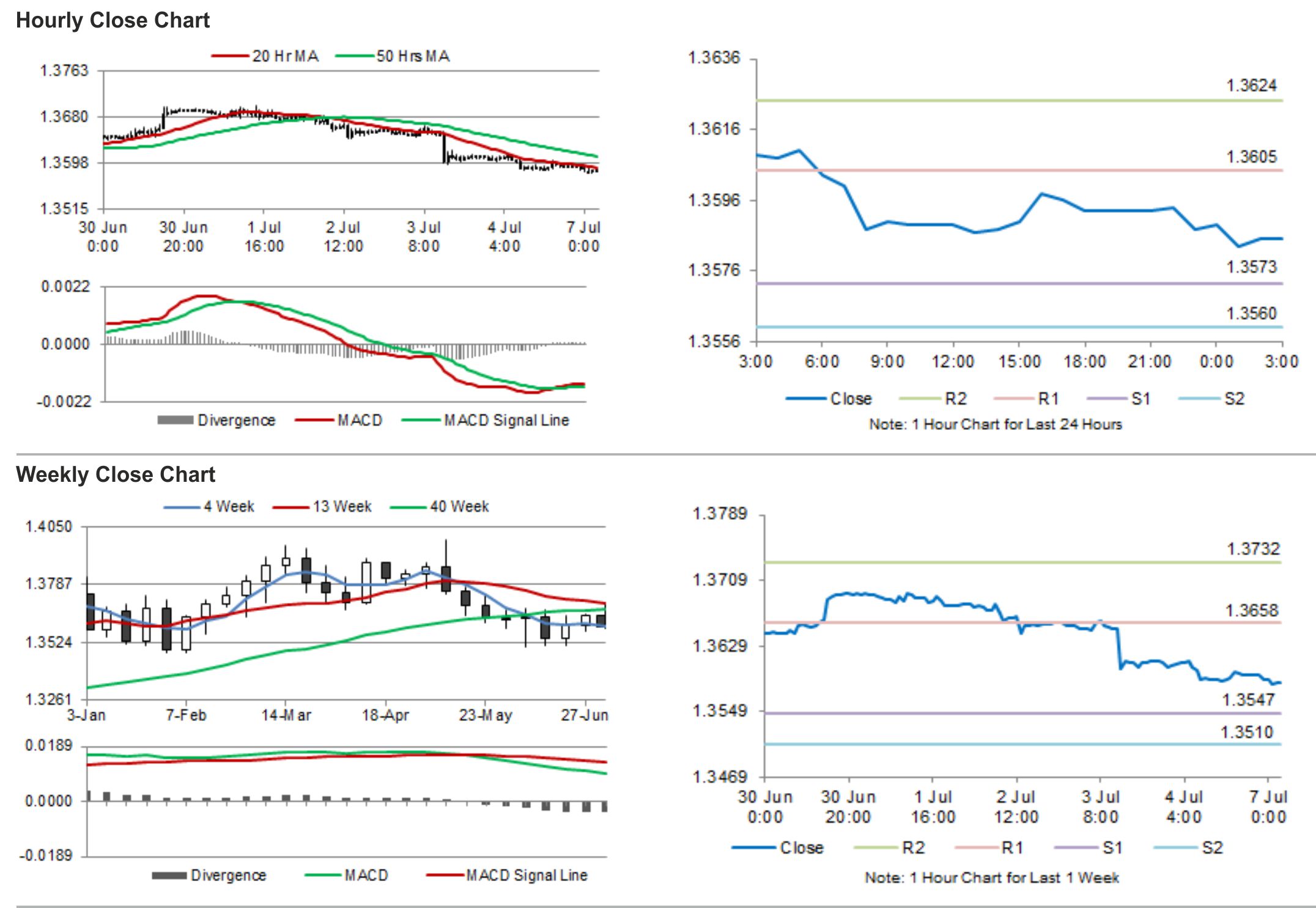

The pair is expected to find support at 1.3573, and a fall through could take it to the next support level of 1.3560. The pair is expected to find its first resistance at 1.3605, and a rise through could take it to the next resistance level of 1.3624.

Trading trends in the pair today are expected to be determined by the release of German industrial production data and Sentix Investor Confidence data from the Euro-zone.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.