For the 24 hours to 23:00 GMT, the EUR declined 0.23% against the USD and closed at 1.0643, after the European Central Bank (ECB) Chief, Mario Draghi, stated that it was too soon to wind down the central bank’s stimulus program, even though the Euro-zone economy is strengthening and added that there was scant evidence that inflation was approaching the central bank’s target.

Separately, minutes from the ECB’s March meeting showed that committee members broadly agreed that a substantial degree of stimulus is still needed.

On the data front, Germany’s seasonally adjusted factory orders rebounded 3.4% on a monthly basis in February, driven by strong domestic demand, compared to a revised fall of 6.8% in the previous month, while market participants expected a gain of 4.0%. Moreover, activity in the nation’s construction sector accelerated at the fastest pace in over a year, with the PMI advancing to a level of 56.4 in March, following a reading of 54.1 in the prior month.

The greenback gained ground against a basket of currencies, lifted by the release of upbeat US jobless claims data.

The US initial jobless claims fell more-than-expected to a level of 234.0K in the week ended 01 April 2017, hitting its lowest level in nearly two-years and pointing to a further tightening in the nation’s labour market. Initial jobless claims had recorded a revised reading of 259.0K in the prior week, compared to market expectations of a fall to a level of 250.0K.

Meanwhile, investors remained nervous amid caution over an impending summit between US President, Donald Trump and Chinese President, Xi Jinping.

In the Asian session, at GMT0300, the pair is trading at 1.0644, with the EUR trading marginally higher against the USD from yesterday’s close.

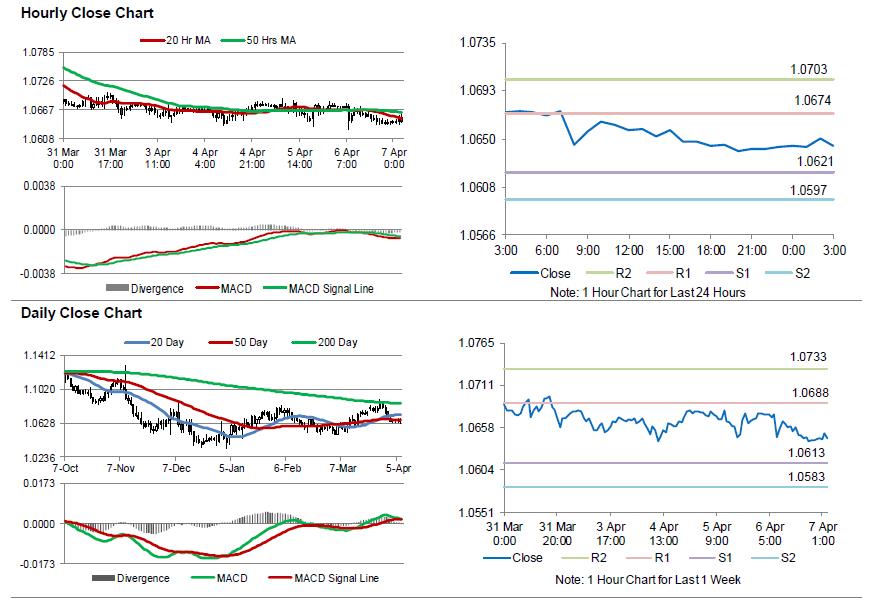

The pair is expected to find support at 1.0621, and a fall through could take it to the next support level of 1.0597. The pair is expected to find its first resistance at 1.0674, and a rise through could take it to the next resistance level of 1.0703.

Trading trend in the Euro today is expected to be determined by the release of Germany’s industrial production and trade balance figures, both for February, slated to release in a few hours. Moreover, the US non-farm payrolls and unemployment rate data, both for March, scheduled to release later in the day, will garner a significant amount of market attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.