For the 24 hours to 23:00 GMT, EUR ended the day flat against the USD and closed at 1.3877, giving up its initial gains, after the ECB Governing council member, Christian Noyer, stated that the policymakers did not favoured a stronger Euro, as it created a “downward pressure on the economy as well as on inflation.”

Separately, Olivier Blanchard, IMF’s Chief economist, opined that deflation risks definitely existed in the Euro-zone economy, adding that “longer periods of low inflation would make the necessary adjustments in the region’s economy more difficult.” Meanwhile, the ECB Executive Board member, Sabine Lautenschlaeger, assured that the central bank would definitely take actions if it sees risks to its medium-term price stability outlook. However, he felt that there was no need for the central bank to take any measures in the immediate future as last week the Governing Council found its baseline scenario broadly confirmed in the region.

In economic news, Euro-zone’s Sentix investor confidence rose to a 35-month high reading of 13.9 in March, more than market estimates for a rise to 14.0 and compared to previous month’s reading of 13.3. Meanwhile, industrial production in France fell unexpectedly 0.2% (MoM) in January, following a 0.6% drop recorded in the preceding month. However, industrial production in Italy registered the biggest rise since August 2011 in January.

In the US, the Philadelphia Fed President, Charles Plosser, attributed slackness in the US labour markets to the severe winter and opined that this weakness was only temporary. Furthermore, he noted that the recent inspiring data is not at all enough to determine the change in pace of tapering the central bank’s stimulus package. Separately, Charles Evans, President of the Chicago Fed, revealed that policymakers are discussing ways to craft a new forward guidance, adding that the next stage of forward guidance would focus more on “qualitative” guidance rather than the current system of numerical thresholds.

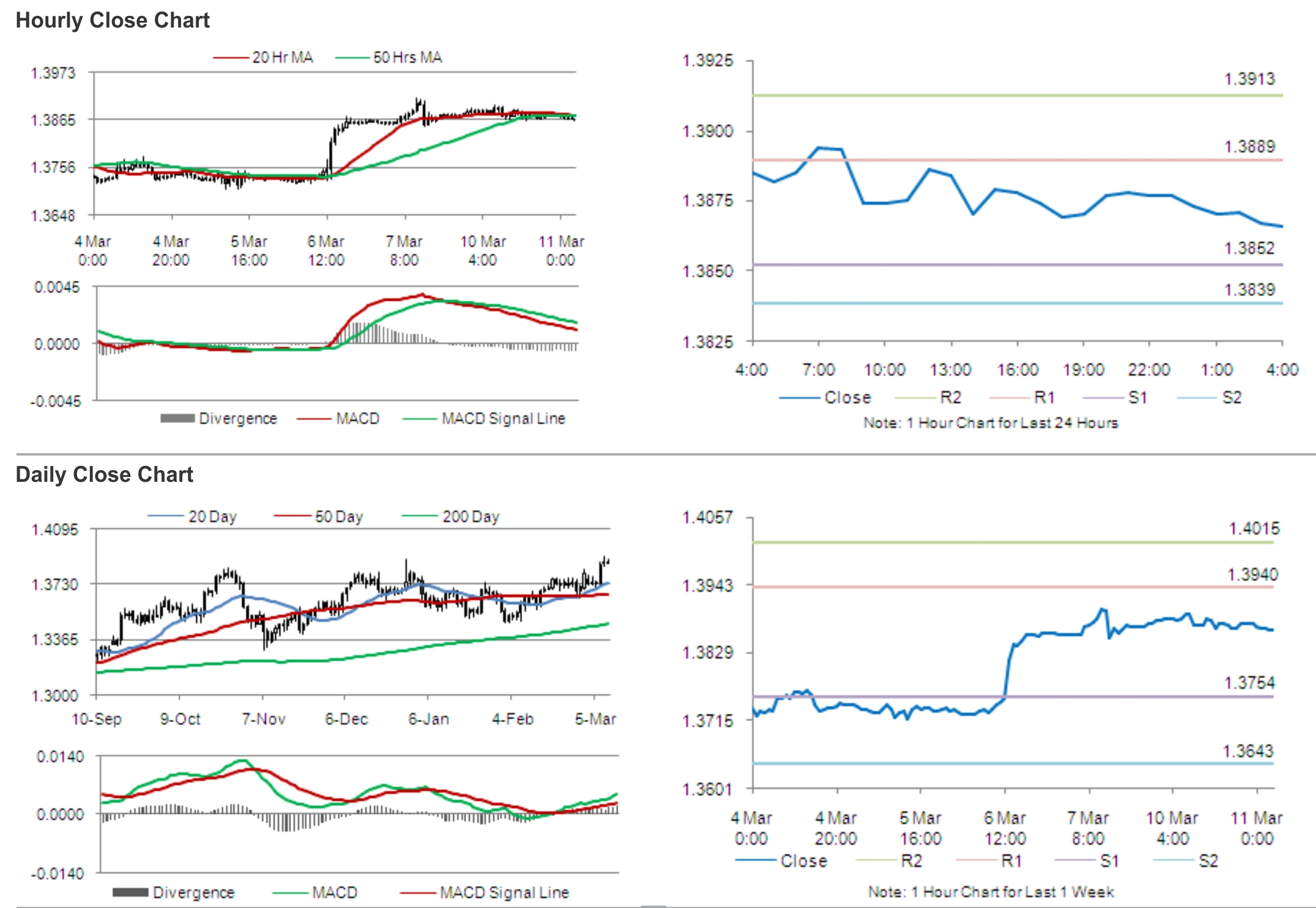

In the Asian session, at GMT0400, the pair is trading at 1.3866, with the EUR trading 0.08% lower from yesterday’s close.

The pair is expected to find support at 1.3852, and a fall through could take it to the next support level of 1.3839. The pair is expected to find its first resistance at 1.3889, and a rise through could take it to the next resistance level of 1.3913.

Traders would keep an eye on Germany’s trade balance data for further cues in the Euro.

The currency pair is trading just below its 20 Hr and 50 Hr moving averages.