For the 24 hours to 23:00 GMT, the EUR declined 0.70% against the USD and closed at 1.0880.

Yesterday, the ECB increased its emergency lending to the Greek bank by €900 million over one week. The decision came after the Greek parliament approved the austerity measures demanded by the creditors, thus paving the way for a bailout package. Meanwhile, the central bank in its latest monetary policy meeting opted to keep its key interest rate at record low of 0.05%.

In other economic news, the Euro-zone’s final estimate of consumer price inflation slipped back to zero on a monthly basis in June, at par with consensus estimates. It followed an increase of 0.2% in the previous month. Meanwhile, the seasonally adjusted trade surplus narrowed more than expected to €21.20 billion in May, compared to a revised surplus of €23.90 billion in the prior month.

The greenback gained ground, after the number of Americans claiming jobless benefits for the first eased more than expected to 281 K in the week ended 11 July, compared to revised level of 296 K in the previous week. Other economic data showed that the US NAHB housing market index remained unchanged at a level of 60.00 in July, while markets were expecting it to drop to 59.00. The Philadelphia Fed manufacturing index dropped to 5.70 in July in the US, lower than market expectations of a drop to a level of 12.00. after registering a reading of 15.20 in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.0898, with the EUR trading 0.16% higher from yesterday’s close.

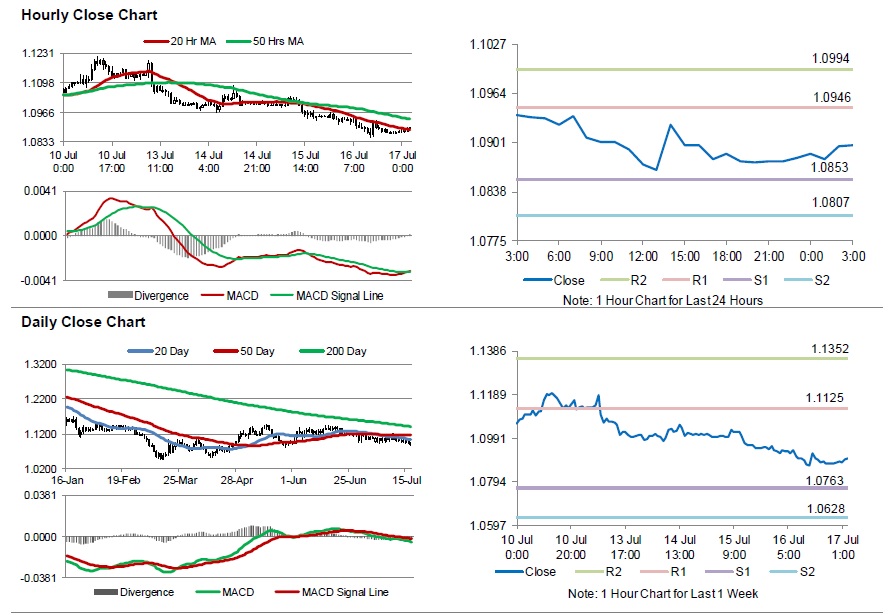

The pair is expected to find support at 1.0853, and a fall through could take it to the next support level of 1.0807. The pair is expected to find its first resistance at 1.0946, and a rise through could take it to the next resistance level of 1.0994.

Trading trends in the pair today are expected to be determined by the US consumer price inflation data, scheduled later today.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.