For the 24 hours to 23:00 GMT, the EUR declined 0.48% against the USD and closed at 1.1002.

Data released showed that the seasonally adjusted industrial production in Germany remained flat on a MoM basis, less than market expectations for an advance of 0.10%. It had risen by a revised 0.60% in the prior month.

Yesterday, the Euro-zone officials gave Greece five days to avoid bankruptcy and told the Greek government to return with new proposals by Thursday to finalize a deal with its creditors.

In the US, the trade deficit unexpectedly fell to $41.87 billion in May, compared to prior month’s deficit of $40.70 billion. Meanwhile, JOLTs job openings unexpectedly rose to a level of 5,363 K, higher than market expectations of a drop to a level of 5,300 K. In the prior month, it had recorded a revised reading of 5,334 K, while the economic optimism index remained unchanged at a level of 48.10 in July, lower than market expectations of a rise to a level of 48.80.

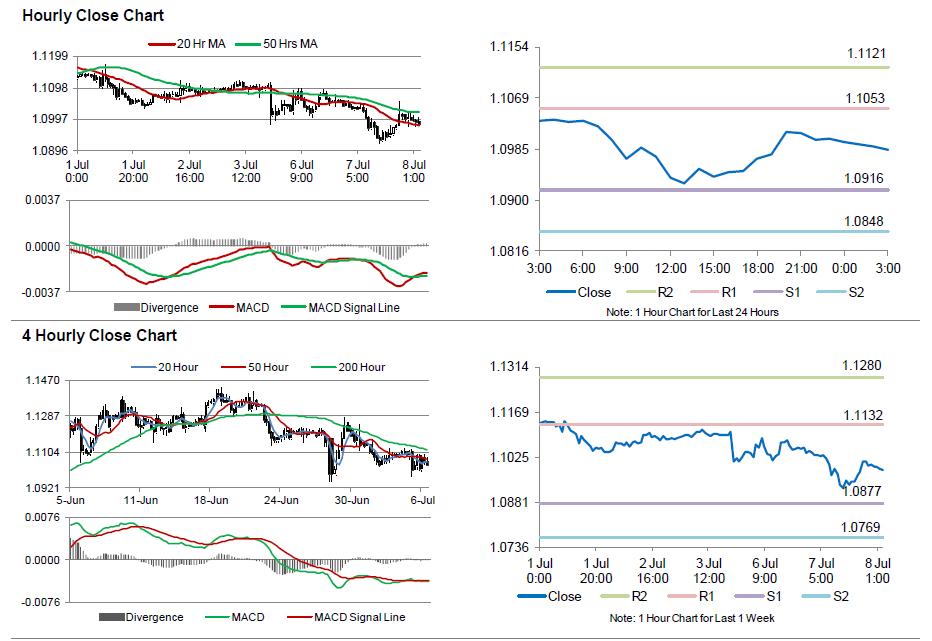

In the Asian session, at GMT0300, the pair is trading at 1.0985, with the EUR trading 0.16% lower from yesterday’s close.

The pair is expected to find support at 1.0916, and a fall through could take it to the next support level of 1.0848. The pair is expected to find its first resistance at 1.1053, and a rise through could take it to the next resistance level of 1.1121.

Trading trends in the pair today would be determined by the US FOMC minutes from its recent monetary policy meeting, scheduled later today.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.