For the 24 hours to 23:00 GMT, the EUR rose 1.09% against the USD and closed at 1.1415.

In the US, the Fed decided to maintain its benchmark interest rates unchanged at near-zero, but expressed concerns about a weak global economy. However, the central bank left open the possibility of an interest rate hike later this year. Meanwhile, the Fed slashed its economic growth projections for 2016 to 2.3% from 2.7% estimated earlier and an expansion of 2.2% for 2017, down from previous projection of 2.5%, citing recent tumult in the global financial markets.

Other economic news indicated that the number of Americans filing for jobless benefits for the first time unexpectedly dropped to an eight-week low level of 264,000 in the week ended 12 September, compared to prior month’s reading of 275,000, thereby indicating continued improvement in the US labour market. Additionally, building permits in the nation rebounded stronger than expected by 3.5% MoM in August, from a revised fall of 15.5% in July. On the other hand, housing starts dipped less than anticipated by 3.0%, compared to a revised drop of 4.1% in the preceding month. Also, the Philadelphia Fed business index surprisingly contracted to a level of -6.0 in September, marking its first negative reading since February 2014. It followed a reading of 8.3 recorded in August.

Elsewhere, in the Euro-zone construction output rebounded 1.0% on a monthly basis in July, compared to a revised decline of 1.2% in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1405, with the EUR trading 0.09% lower from yesterday’s close.

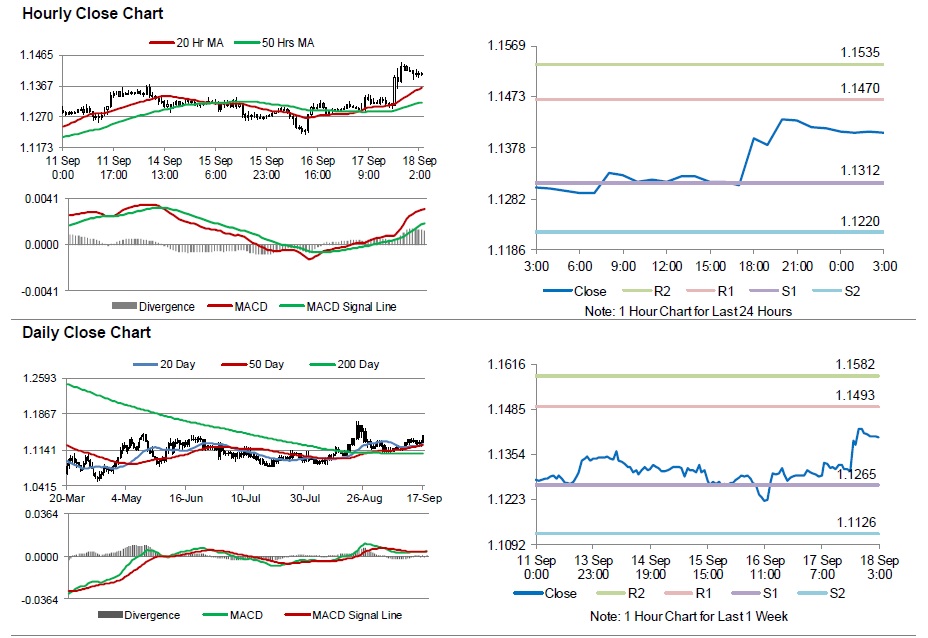

The pair is expected to find support at 1.1312, and a fall through could take it to the next support level of 1.1220. The pair is expected to find its first resistance at 1.1470, and a rise through could take it to the next resistance level of 1.1535.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.