For the 24 hours to 23:00 GMT, the EUR declined 0.10% against the USD and closed at 1.0927.

Yesterday, the Greek lawmakers approved second set of crucial reforms to secure and begin the €86 billion European Union bailout. However, 31 members of the Syriza party voted against it.

In the US, existing homes sales jumped more than expected by 3.2% MoM in June, compared to a revised rise of 4.5% in the preceding month. Meanwhile, the nation’s house price index rose 0.4% on a monthly basis in May, in line with market expectations and compared to a similar revised increase registered in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.095, with the EUR trading 0.21% higher from yesterday’s close.

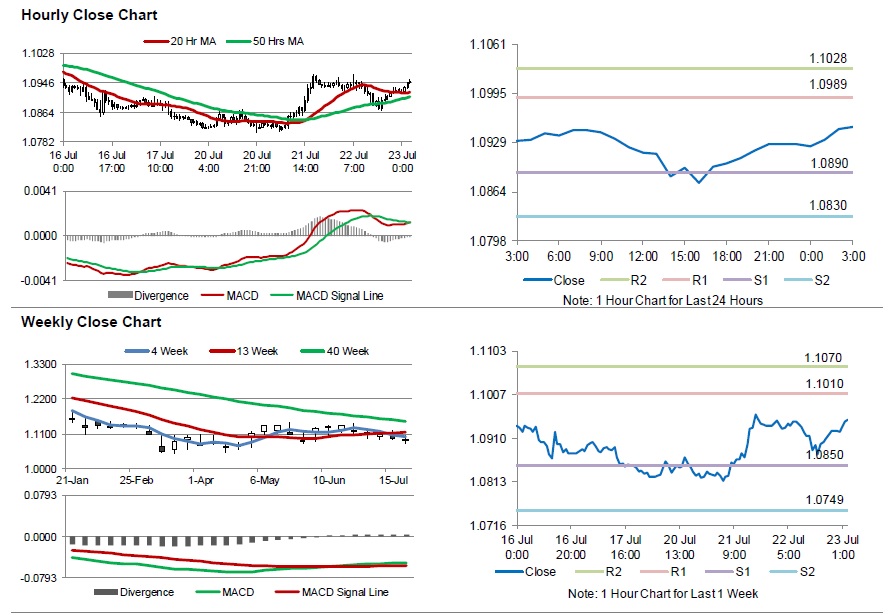

The pair is expected to find support at 1.089, and a fall through could take it to the next support level of 1.083. The pair is expected to find its first resistance at 1.0989, and a rise through could take it to the next resistance level of 1.1028.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s consumer confidence data, scheduled in a few hours. Additionally, the US initial jobless claims data, scheduled later today would also grab market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.