For the 24 hours to 23:00 GMT, the EUR declined 0.51% against the USD and closed at 1.0957.

Yesterday, the Greek Parliament approved the new bailout package of €86 billion, coming with tough austerity measures demanded by its international lenders. The Parliament voted “Yes” to go ahead with the deal, as the cash-strapped nation needed the bailout money to revive the nation’s economy which is on the verge of collapse.

The greenback was boosted, after the Fed Chairwoman, Janet Yellen, in her Congressional Testimony, echoed for an interest rate hike later this year, citing improvement in the US labour market conditions.

In other economic news, industrial production in the US rebounded 0.3% in June, beating forecasts of a 0.2% rise and following a 0.2% drop in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.0937, with the EUR trading 0.18% lower from yesterday’s close.

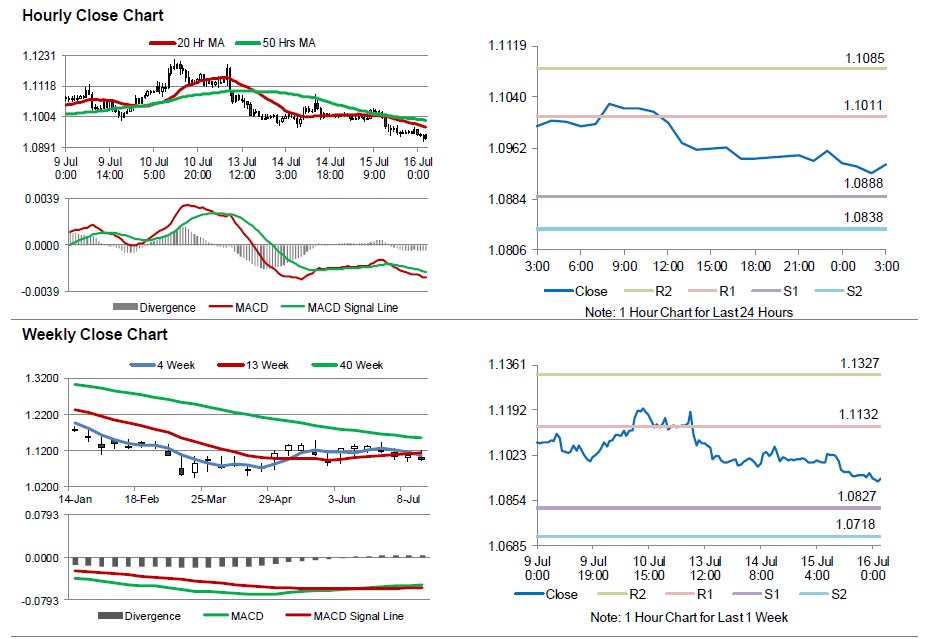

The pair is expected to find support at 1.0888, and a fall through could take it to the next support level of 1.0838. The pair is expected to find its first resistance at 1.1011, and a rise through could take it to the next resistance level of 1.1085.

Trading trends in the Euro today are expected to be determined by the ECB’s interest rate decision, scheduled in a few hours. Additionally, the US initial jobless claims data, scheduled later today would generate lot of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.