For the 24 hours to 23:00 GMT, EUR declined 0.33% against the USD, on Friday, and closed at 1.3773, amid continued concerns over the debt crisis in the Euro-zone.

Late Sunday, the Greeck Prime Minister George Papandreou agreed to step down after the country’s political leaders reached an agreement on Sunday night to form a new unity government.

In economic news, the Producer Price Index (PPI) in the Euro-zone rose 0.3% (M-o-M) in September compared to a 0.2% decline in the previous month. The final composite Purchasing Managers’ Index (PMI) in the Euro-zone declined to 46.5 in October, from the flash estimate of 47.2.

Additionally, in Germany, the services Purchasing Managers’ Index (PMI) declined to 50.6 in October, lower than the flash estimate of 52.1 in October. The factory orders declined 4.3% (M-o-M) in September compared to 1.4% declined in August.

In the Asian session, at GMT0400, the pair is trading at 1.3774, with the EUR trading flat from Friday’s close.

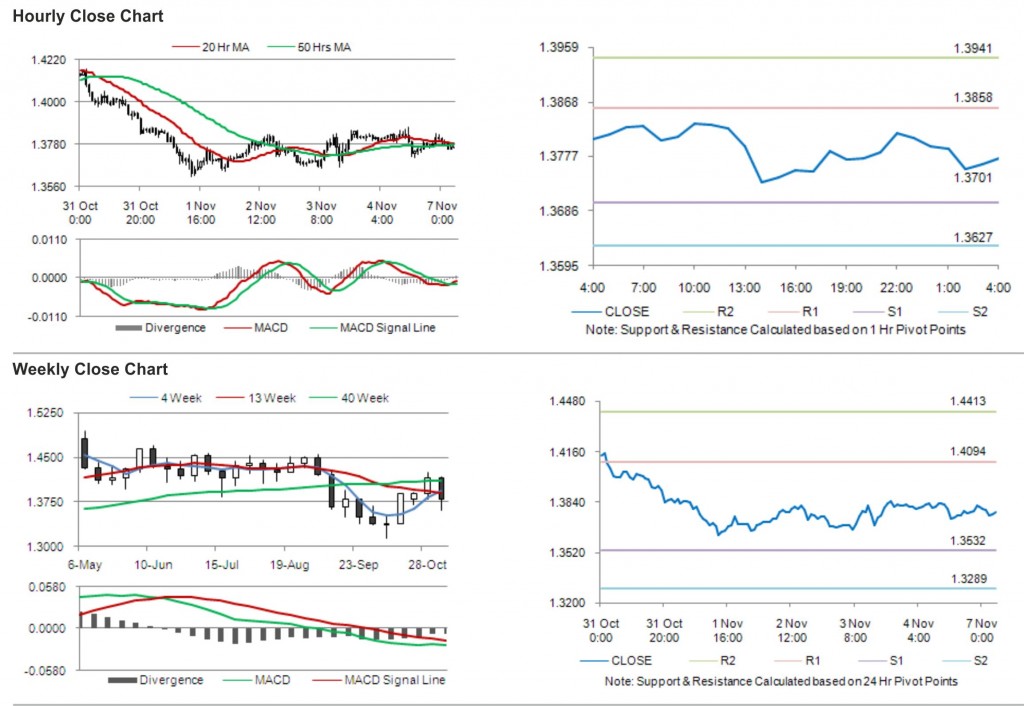

The pair is expected to find support at 1.3701, and a fall through could take it to the next support level of 1.3627. The pair is expected to find its first resistance at 1.3858, and a rise through could take it to the next resistance level of 1.3941.

Trading trends in the pair today are expected to be determined by release of retail sales data and Sentix investor confidence index in the Euro-zone.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.