On Friday, for the 24 hours to 23:00 GMT, EUR rose 0.50% against the USD and closed at 1.4232.

Fitch Ratings downgraded Portugal’s long-term foreign and local currency issuer default ratings to BBB-, from A- and kept the ratings on negative watch. Additionally, Standard & Poor’s lowered Ireland’s credit rating by one notch to BBB+ from A-, but said the outlook is stable and the stress test results were credible.

Data released in Eurozone showed that the Markit Eurozone Manufacturing purchasing managers’ index (PMI) declined to 57.5 in March, while the unemployment rate dropped to 9.9% in February, down from 10% in January. Additionally, German manufacturing PMI eased to 60.9 in March from 62.7 in February, while the French manufacturing PMI fell to 55.4 in March, from 55.7 in February.

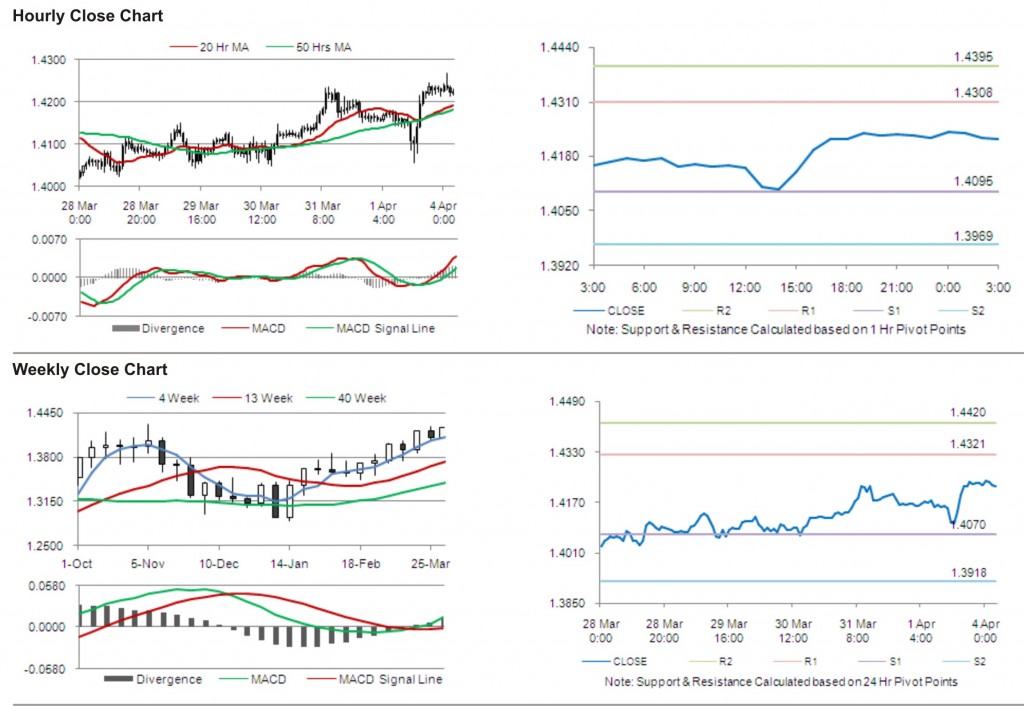

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4221, 0.08% lower from the levels yesterday at 23:00GMT.

The pair has its first short term resistance at 1.4308, followed by the next resistance at 1.4395. The first support is at 1.4095, with the subsequent support at 1.3969.

Trading trends in the pair today are expected to be determined by sentix investor confidence and producer price index data in the Eurozone, due to be released later today.

The currency pair is trading just above its 20 Hr and 50 Hr moving averages.