For the 24 hours to 23:00 GMT, EUR rose 1.28% against the USD, on Friday and closed at 1.4483, as investors ignored the greenback on the fears of the US government shutdown.

The European Union (EU) minister agreed to prepare the financial assistance package to Portugal immediately and they intend to reach an agreement by mid-May.

The Federal Reserve Bank of Atlanta President, Dennis Lockhart informed that the European Central Bank’s (ECB) decision to raise interest rates, wouldn’t influence his view of the US central bank policy.

In the EU, the Germany trade balance showed a surplus of €12.1 billion in February compared to a surplus of €10.1 billion recorded in the previous month. Additionally, current account surplus stood at €8.9 billion in February compared to a surplus of €10.2 billion recorded in the previous year.

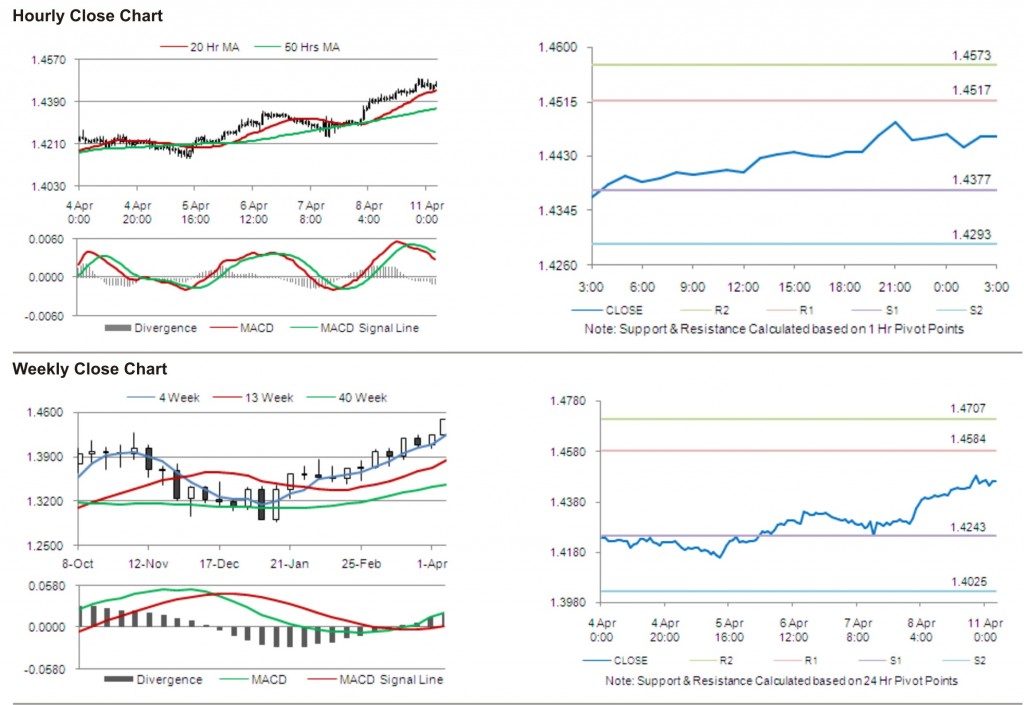

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4461, 0.15% lower from the levels yesterday at 23:00GMT.

The pair has its first short term resistance at 1.4517, followed by the next resistance at 1.4573. The first support is at 1.4377, with the subsequent support at 1.4293.

Trading trends in the pair today are expected to be determined by German wholesale price index and French industrial production data due to be released later today.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.