For the 24 hours to 23:00 GMT, EUR declined 0.14% against the USD and closed at 1.3655.

On the economic front, the Federal Statistical Office Germany indicated that the import price index in Germany remained flat in December on a monthly basis, compared to a 0.1% increase in the previous month. Markets were expecting the import price index to climb 0.2% in December. Meanwhile, the consumer confidence in France unexpectedly increased to a level of 86.0 in January, compared to a reading of 85.0 reported in December. Market had estimated the index to remain steady in January. Additionally, the consumer confidence in Italy rose to a reading of 98.0 in January, higher than market expectation of a reading of 96.7 and compared to a revised reading of 96.4 reported in the earlier month.

Yesterday, the International Monetary Fund Managing Director, Christine Lagarde stated that high unemployment and in particular long-term unemployment continue to be the top concerns in the Euro-zone, and the region can find solutions by enhancing growth in the region, through steps including reducing debt levels and completing the banking union.

Meanwhile, the US Dollar lost momentum initially after the US durable goods orders unexpectedly slumped in December by the most in five months. The US Census Bureau reported that the durable goods orders sank 4.3% in December, confounding analysts’ expectations for a 1.8% increase and compared to a revised rise of 2.6% recorded in November. Separately, the Richmond Fed manufacturing index declined slightly to a reading of 12.0 in January, and from a reading of 13.0 reported in the previous month. However, the US Dollar received support after data revealed that the confidence among US consumers surprisingly edged up to a five-month high in January, on the back of growing optimism about the economy and improved labour market. The consumer confidence index climbed to a reading of 80.7 in January, above the market expectations for a level of 78.0 and from a level of 77.5 reported in the previous month. On the housing front, the S&P/Case-Shiller home price index indicated that the US home prices reported its largest increase since February 2006, as the house price index climbed at an annualized rate of 13.7% in November, matching forecasts and following a gain of 13.6% in October.

In the Asian session, at GMT0400, the pair is trading at 1.3654, with the EUR trading tad lower from yesterday’s close.

This morning, in his annual State of the Union address, the US President, Barack Obama urged that he would work with the Congress in order to improve the nation’s economy, calling for legislation on an immigration bill and minimum wage hike bill. He further added that the US economy is showing more strength than at any time since the Great Recession began six years ago.

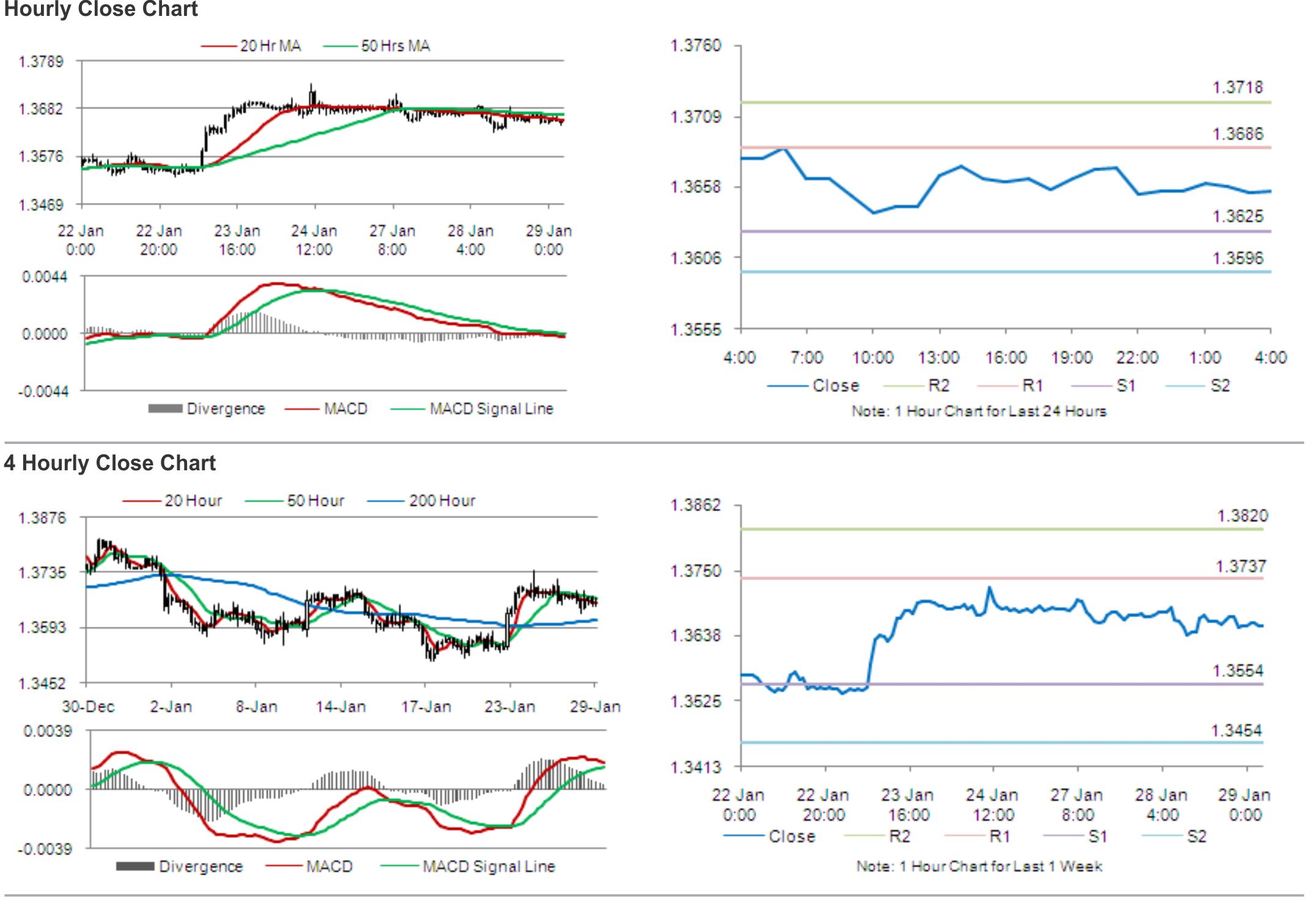

The pair is expected to find support at 1.3625, and a fall through could take it to the next support level of 1.3596. The pair is expected to find its first resistance at 1.3686, and a rise through could take it to the next resistance level of 1.3718.

Trading trends in the pair today are expected to be determined by the outcome of Federal Open Market Committee (FOMC)’s two-day meeting where policy makers are expected to further scale back Fed’s monthly bond purchases.

The currency pair is showing convergence with its 20 Hr moving average and is trading just below its 50 Hr moving average.