For the 24 hours to 23:00 GMT, the EUR declined 0.22% against the USD and closed at 1.3409. The US dollar was boosted after data released indicated that consumer confidence index in the US climbed surprisingly to a seven-year high level of 90.9 in July, higher than market expectations of a level of 85.4, compared to a revised level of 86.4 in the previous month. On the other hand, the Redbook index in the week ended 25 July 2014 decelerated, on an annual basis, while the, S&P/Case-Shiller reported that the house prices in the US rose at its slowest pace since February 2013 in May.

Economic news from Germany, the largest economy of Euro-Zone, registered a lesser than expected rise in the import price index in June. It registered a rise of 0.2% on a monthly basis in June, compared to a flat reading in the previous month, though market forecasted that the import price index would climb 0.3%. Additionally, in Spain, retail sales recorded a rise of 0.2%, on an annual basis, lower than market expectations for an advance of 1.1%. It had climbed 0.5% in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.3412, with the EUR trading tad higher from yesterday’s close.

Earlier today, the ECB Governing Council Member and Bundesbank Chief, Jens Weidmann, welcomed a strong rise in wages in Germany despite inflation pressures in the region continue to be weak.

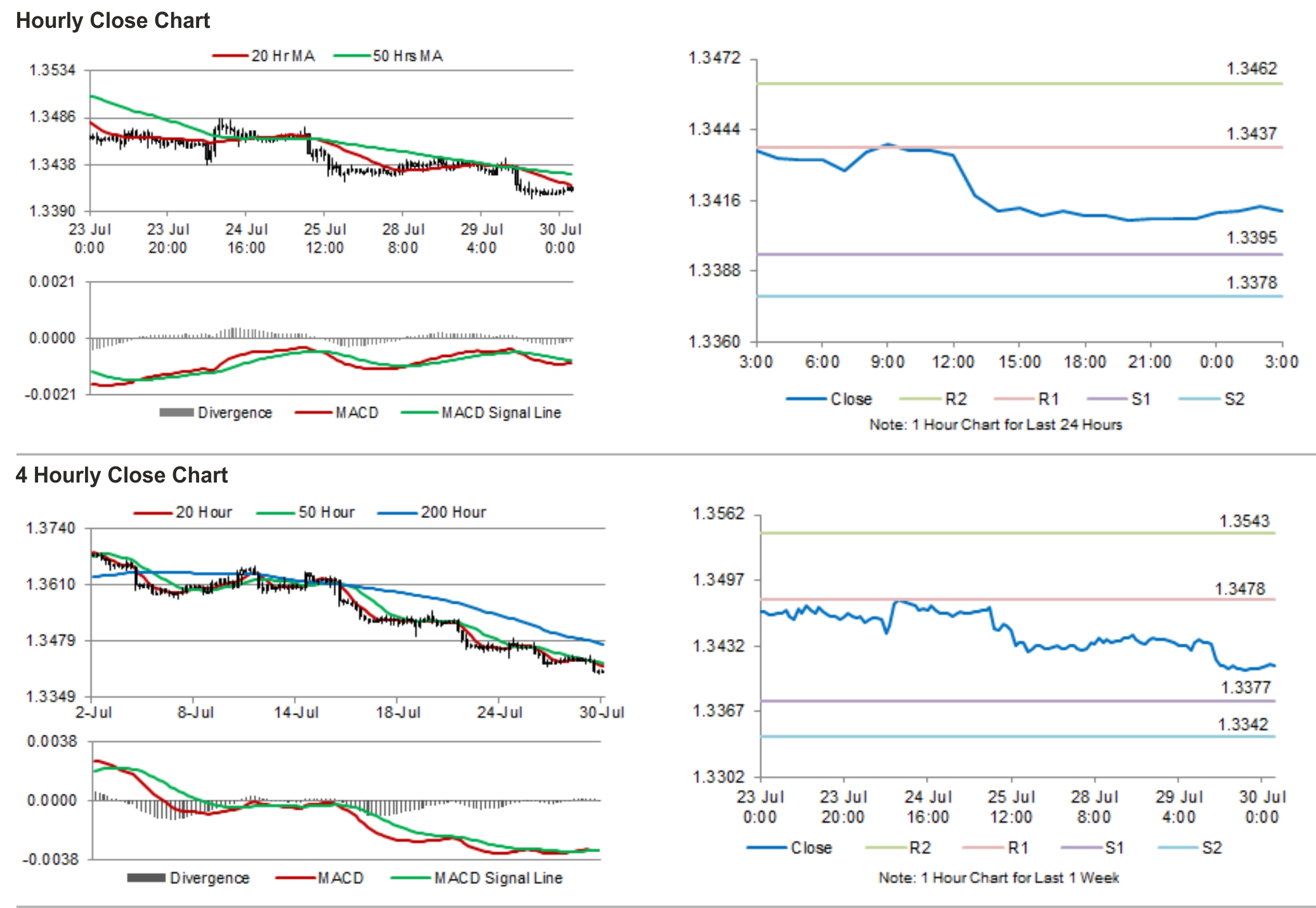

The pair is expected to find support at 1.3395, and a fall through could take it to the next support level of 1.3378. The pair is expected to find its first resistance at 1.3437, and a rise through could take it to the next resistance level of 1.3462.

Going forward, investors would turn all their attention to the outcome of the Federal Reserve’s monetary policy meeting and the US Q2 GDP figures, scheduled to be out later during the day. Meanwhile, Consumer prices data from Germany would also gather investor attention.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.