For the 24 hours to 23:00 GMT, the EUR declined 0.39% against the USD and closed at 1.3568 after disappointing ZEW sentiment indexes for Germany and the Euro-zone and following Janet Yellen’s testimony.

The USD received a boost from Fed Chief, Janet Yellen’s testimony to the Congress in which she mentioned that the central bank would increase its interest rate sooner than expected if the labour market accelerated at a faster pace. However, she added that the monetary policy would continue to remain accommodative for some more time as there still existed a considerable amount of slack in the labour market. She also emphasised that the recovery in the world’s largest economy was not yet complete, despite few indicators pointing to a continued improvement.

On the economic front, retail sales in the US rose at a slower pace and reported a rise of 0.2%, compared to market expectations for a rise of 0.6%. Separately, the New York Empire State manufacturing index rose to a four-year level of 25.6 in July, higher than market expectations of a level of 17.0 and compared to a level of 19.3 in the previous month. Additionally, the business inventories in the US edged up slightly less than economists had expected in May.

The Euro came under pressure after the ZEW Economic Sentiment survey for the Euro-zone plunged to a level of 48.1 in July from previous month’s 58.4. Meanwhile, the German economic sentiment fell to a 19-month low level of 27.1 in July from 29.8 reported in June. Similarly, the current situation measure too plunged to 61.8 in July from previous month’s 67.1.

Meanwhile, after the ECB Chief, Mario Draghi and the IMF expressed concerns about the overvalued Euro, another ECB Board member, Peter Praet yesterday, in an interview, assured that the recent measures implemented by the central bank at its June meeting would have the expected results on the common currency and would eventually cause the Euro to decline.

In the Asian session, at GMT0300, the pair is trading at 1.3564, with the EUR trading tad lower from yesterday’s close.

Earlier today, the Kansas City Fed President, Esther George urged the Federal Reserve to raise its interest rate as soon as possible, as according to him the economy was well prepared for ‘more-normal’ interest rates.

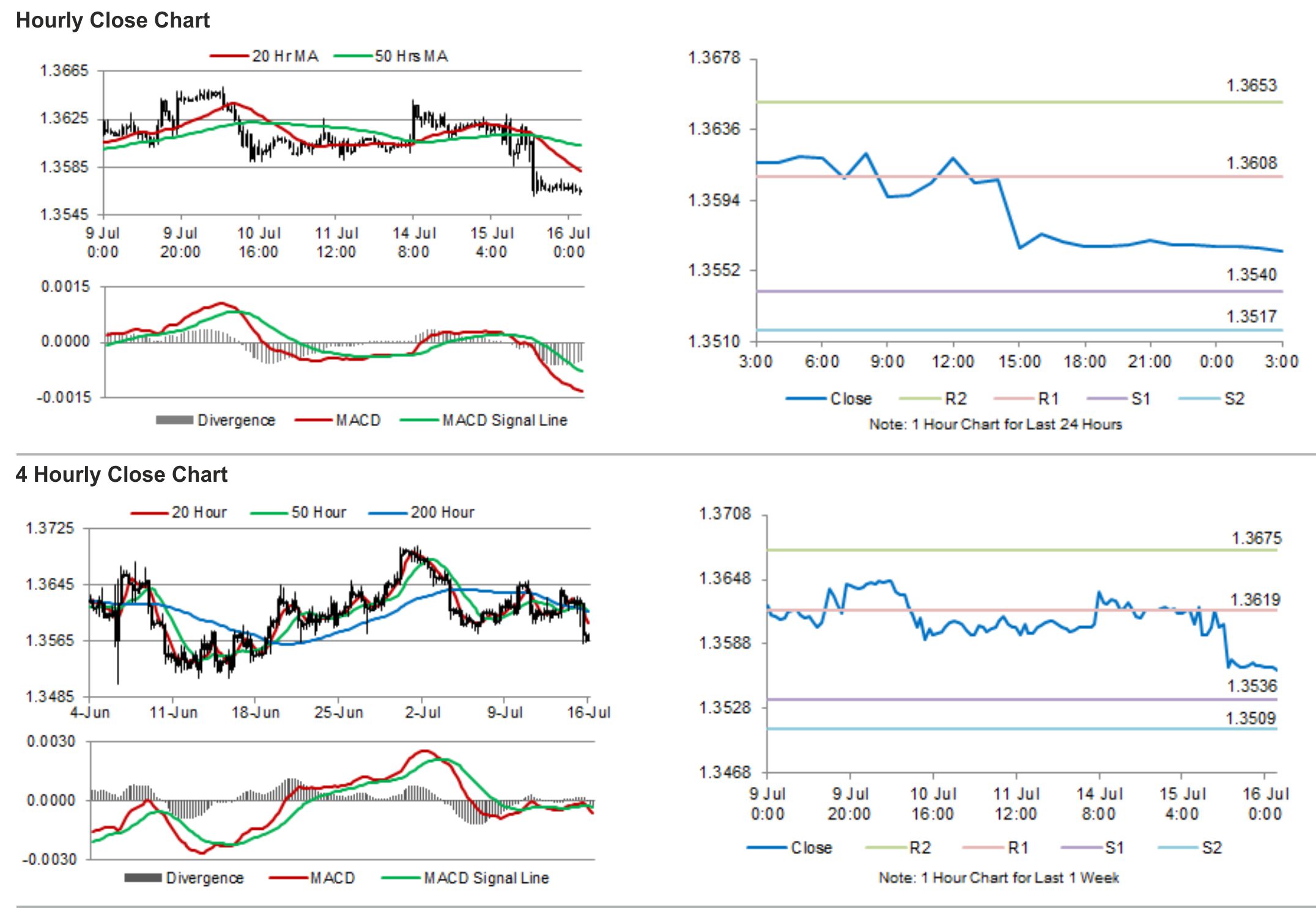

The pair is expected to find support at 1.354, and a fall through could take it to the next support level of 1.3517. The pair is expected to find its first resistance at 1.3608, and a rise through could take it to the next resistance level of 1.3653.

Trading trends in the pair today are expected to be determined by the Euro-zone trade balance data.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.