For the 24 hours to 23:00 GMT, the EUR rose 1.05% against the USD and closed at 1.0709, after the Euro-zone’s ZEW survey of economic sentiment index advanced to a level of 23.2 in January, strengthening to an 11-month high level, amid rising optimism among investors as economic conditions improved across the common currency region. However, the index fell short of market expectations for a rise to a level of 24.2, while it registered a reading of 18.1 in the previous month.

Separately, Germany’s ZEW economic sentiment index showed that German investor morale notched its highest level in seven months, after the index climbed to a level of 16.6 in January, although undershooting market consensus of a rise to a level of 18.4. In the previous month, the index had recorded a level of 13.8. Moreover, the nation’s ZEW current situation index advanced more-than-expected to a level of 77.3 in January, compared to market expectations of a rise to a level of 65.0 and after recording a level of 63.5 in the prior month.

The greenback declined against its major peers, after the US President-elect Donald Trump warned that the US dollar was “too strong” and “killing” American companies.

In economic news, the US New York Empire State manufacturing index unexpectedly dropped to a level of 6.5 in January, defying market expectations for an advance to a level of 8.5 and following a revised reading of 7.6 in the previous month.

Meanwhile, the New York Federal Reserve (Fed) President, William Dudley stated that the US Federal Reserve is unlikely to threaten the expansion with aggressive interest-rate hikes as “inflation is just not a problem”.

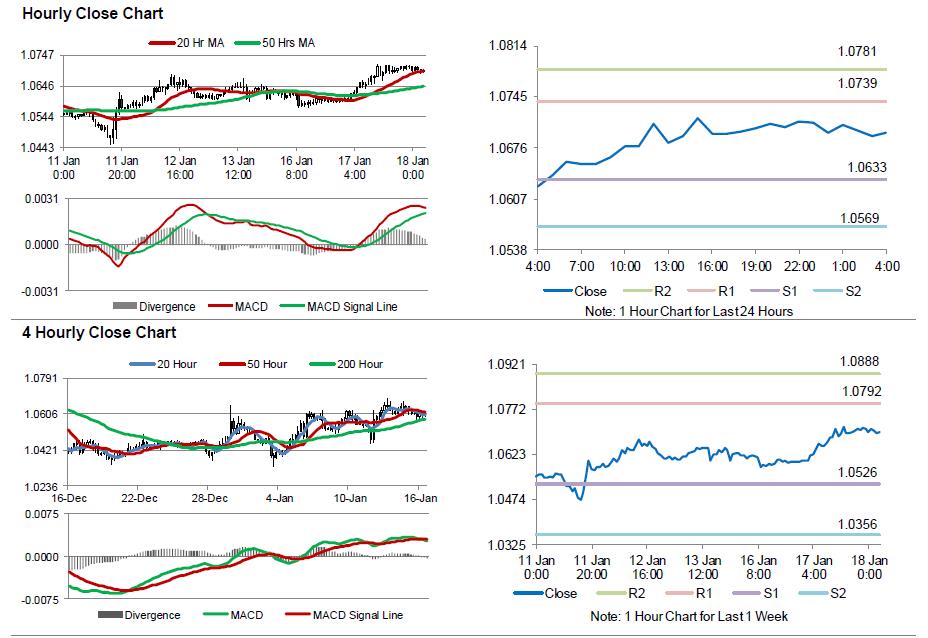

In the Asian session, at GMT0400, the pair is trading at 1.0696, with the EUR trading 0.12% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.0633, and a fall through could take it to the next support level of 1.0569. The pair is expected to find its first resistance at 1.0739, and a rise through could take it to the next resistance level of 1.0781.

Going ahead, market participants will closely monitor consumer price index for December across the Euro-zone, to gauge strength in the region’s economy. Additionally, investors would eye a speech by the US Fed Chairwoman, Janet Yellen and the Fed’s Beige Book, due later today. Moreover, the US consumer price index, industrial and manufacturing production, all for December along with the NAHB housing market index for January, slated to release later in the day, will be keenly watched by investors.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.