For the 24 hours to 23:00 GMT, the EUR rose 0.24% against the USD and closed at 1.0985.

In the US, data showed that the JOLTs job openings unexpectedly fell to level of 7051.0K in August, declined to its lowest level since March 2018 and defying market expectations for an advance to a level of 7191.0K. In the previous month, JOLTs job openings had registered a revised level of 7174.0K. Meanwhile, the nation’s MBA mortgage applications rose 5.4% on a weekly basis in the week ended 04 October 2019. Mortgage applications had advanced 8.1% in the prior week.

The Federal Reserve (Fed), in its latest monetary policy meeting minutes revealed that the officials expressed concerns over the US economic growth, amid ongoing trade tensions between the US and its counterparts. Also, few members expressed concerns about market expectations for rate cuts. Moreover, the minutes showed that risks to the economic growth outlook had increased since their July meeting. Further, it indicated the likelihood of a recession in the medium term had increased due to risks associated with the trade war and geopolitical tensions.

In the Asian session, at GMT0300, the pair is trading at 1.0990, with the EUR trading 0.05% higher against the USD from yesterday’s close.

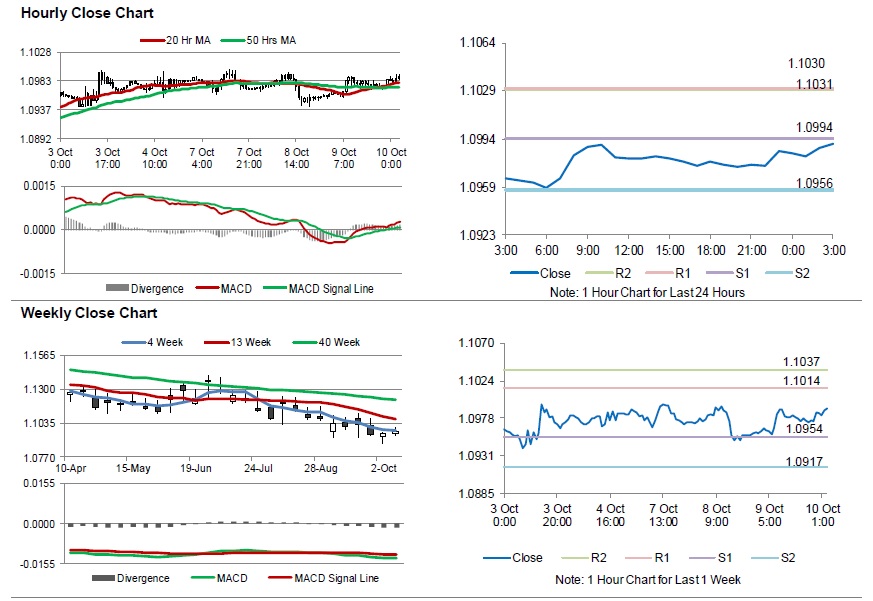

The pair is expected to find support at 1.0994, and a fall through could take it to the next support level of 1.0956. The pair is expected to find its first resistance at 1.1031, and a rise through could take it to the next resistance level of 1.1030.

Looking ahead, traders would await the European Central Bank’s monetary policy meeting minutes followed by Germany’s trade balance data for August, set to release in a few hours. Later in the day, the US consumer price index and monthly budget statement, both for September, along with initial jobless claims will keep traders on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.