For the 24 hours to 23:00 GMT, GBP rose 0.17% against the USD and closed at 1.6125.

In economic news, the British Retail Consortium (BRC) reported that UK retail sales rose 2.3% on a like-for-like basis in January, from the 0.3% fall in the last month. Meanwhile, RICS housing market net price balance rose 8 points to reach -31 in January 2011, from -39 in December. Additionally in the US, consumer credit for December rose by $6.1 billion, after an increase of $2.02 billion in November.

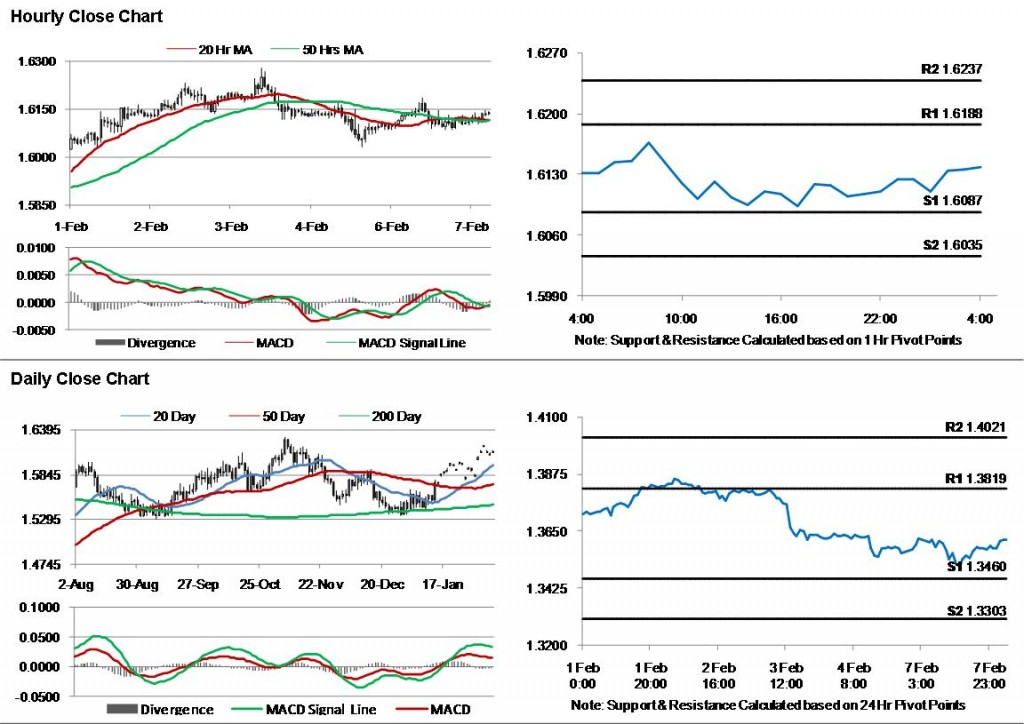

The pair opened the Asian session at 1.6138, and is trading at 1.6138 at 4.00GMT. The pair is trading 0.08% higher from the New York session close.

The pair has its first short term resistance at 1.6188, followed by the next resistance at 1.6237. The first support is at 1.6087, with the subsequent support at 1.6035.

The pair has shown some convergence of its 20Hr and 50Hr moving averages recently. It is currently trading just above its 20 Day and 50 Day moving averages.

Trading trends in the pair today are expected to be determined by the release of US economic data such as ABC/ Washington post consumer confidence, JOLT’s job openings data, and IBD/TIIP economic optimism data.