For the 24 hours to 23:00 GMT, the GBP declined 0.32% against the USD and closed at 1.2888, after the Bank of England (BoE) trimmed Britain’s 2017 economic growth outlook.

The BoE, at its latest monetary policy meeting, opted to keep its interest rates steady at a record low level of 0.25%, with one member, Kristen Forbes, again voting in favour of an immediate rate hike. Further, the BoE lowered its growth forecast for this year to 1.9% from 2.0%, while raised it for 2018 to 1.7% from 1.6%. Moreover, the bank revised up its inflation forecast, expecting inflation to peak at just below 3.0% in the fourth quarter. In a post meeting statement, the BoE Governor, Mark Carney, warned of a sharper-than-expected squeeze on household income, while also suggested that the central bank could raise rates more sharply than expected if Brexit talks go smoothly and the economy remains stable.

Prior to the monetary policy meeting, the Pound fell against the USD after the latest economic data indicated that the UK economy slowed sharply in the first quarter.

Britain’s industrial production dropped more-than-expected by 0.5% on a monthly basis in March, dropping for a third consecutive month and compared to market expectations for a drop of 0.4%. Industrial production had fallen by a revised 0.8% in the prior month. Further, the nation’s manufacturing production eased 0.6% MoM in March, more than market expectations for a drop of 0.2%. In the prior month, manufacturing production had dropped by a revised 0.3%. Also, construction output unexpectedly eased 0.7% MoM in March, defying market expectations for an advance of 0.4%. In the previous month, construction output had registered a revised drop of 1.3%. Moreover, the nation’s total trade deficit widened more-than-expected to a level of £4.9 billion in March, compared to a revised deficit of £2.7 billion in the previous month.

In other economic news, leading think tanker, NIESR estimated that UK’s gross domestic product (GDP) advanced 0.2% in the three months to April 2017, whereas investors had envisaged for a rise of 0.4%. In the January-March 2017 period, NIESR estimated GDP had climbed by a revised 0.3%.

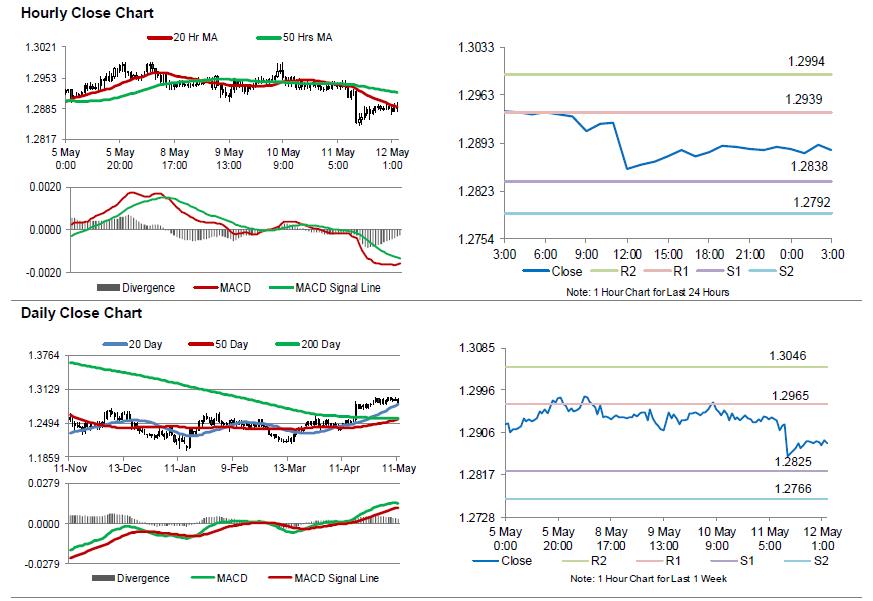

In the Asian session, at GMT0300, the pair is trading at 1.2884, with the GBP trading slightly lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2838, and a fall through could take it to the next support level of 1.2792. The pair is expected to find its first resistance at 1.2939, and a rise through could take it to the next resistance level of 1.2994.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.