For the 24 hours to 23:00 GMT, the GBP declined 1.63% against the USD and closed at 1.3111, after the Bank of England (BoE) cut its benchmark interest rate for the first time since 2009 to a record low level of 0.25%, in line with market expectations and also revived a bond-buying program to combat the economic blow from Britain’s decision to leave the European Union (EU). The central bank also announced that the asset purchase facility would be increased by £60 billion to £435 billion and the bank would commit to bond purchases of up to £10bn. In a speech post meeting, the BoE Governor, Mark Carney, vowed that the central bank would take “whatever action is necessary” to achieve stability in the wake of Brexit vote. Further, the central bank sharply downgraded its growth forecast for 2017 to 0.8% from 2.3%, marking the biggest downgrade and added that the nation’s economic growth is expected to stagnate in the second half of this year and suffer weak growth throughout next year.

In the Asian session, at GMT0300, the pair is trading at 1.3132, with the GBP trading 0.16% higher against the USD from yesterday’s close.

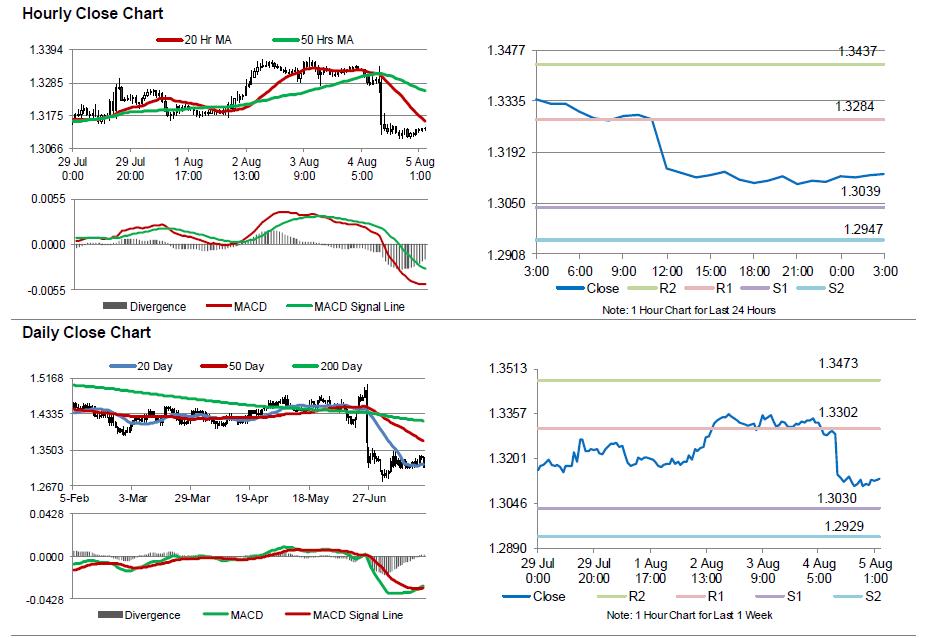

The pair is expected to find support at 1.3039, and a fall through could take it to the next support level of 1.2947. The pair is expected to find its first resistance at 1.3284, and a rise through could take it to the next resistance level of 1.3437.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.