For the 24 hours to 23:00 GMT, the GBP rose 1.78% against the USD and closed at 1.3338, after the Bank of England (BoE) surprisingly kept its benchmark interest rate steady at 0.5% in its first meeting since Britain voted to leave the European Union. Further, the minutes of the meeting disclosed that most policymakers expect further loosening of monetary policy in the next month, once the central bank has assessed how the June 23 referendum decision has affected the economy.

In the Asian session, at GMT0300, the pair is trading at 1.3444, with the GBP trading 0.79% higher against the USD from yesterday’s close.

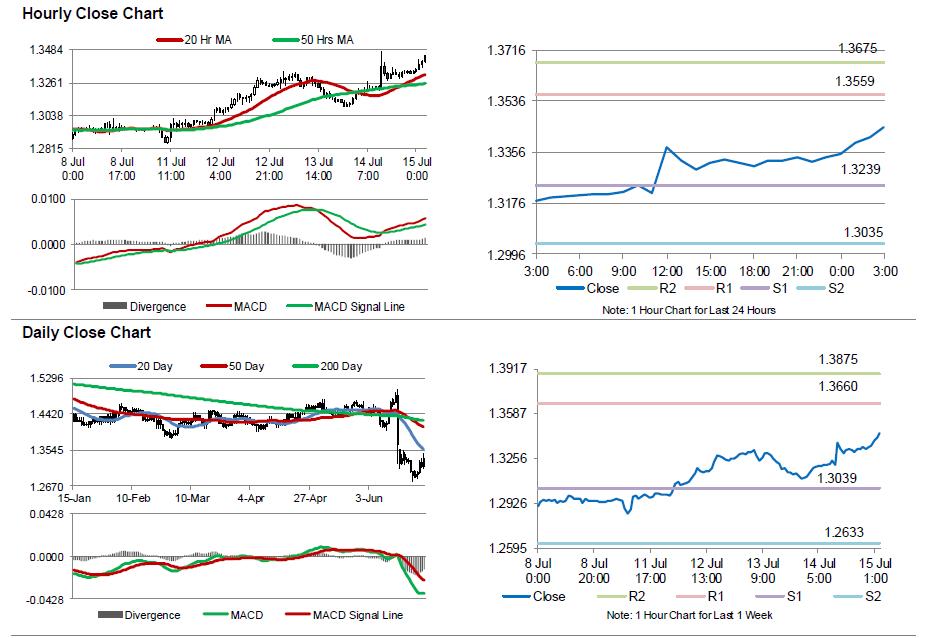

The pair is expected to find support at 1.3239, and a fall through could take it to the next support level of 1.3035. The pair is expected to find its first resistance at 1.3559, and a rise through could take it to the next resistance level of 1.3675.

Moving ahead, market participants await BoE Governor, Mark Carney’s speech, due later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.