For the 24 hours to 23:00 GMT, the GBP fell 0.18% against the USD and closed at 1.5157, after the BoE expressed concerns over UK’s inflation and wage growth.

Yesterday, The BoE left the benchmark interest rate unchanged at a record low of 0.5%, as it highlighted subdued inflation in the UK due to the recent fall in oil prices. Further, the central bank decided to hold off on adding to the £375 billion asset purchase facility, as expected. The BoE Governor, Mark Carney, stated that a renewed fall in oil prices since the last meeting and a restrained wage growth increased the likelihood that inflation rates would remain subdued. The BoE also reiterated that it expected headline inflation to remain below 1.0% until the second half of 2016.

In other economic news, UK’s total trade deficit widened more-than-expected to £4.1 billion in October, as imports grew at its fastest pace in nearly a year and as the global economic slowdown weighed on demand for exports. The nation had posted a revised total trade deficit of £1.1 billion in the previous month, while markets were anticipating it to rise to £1.8 billion.

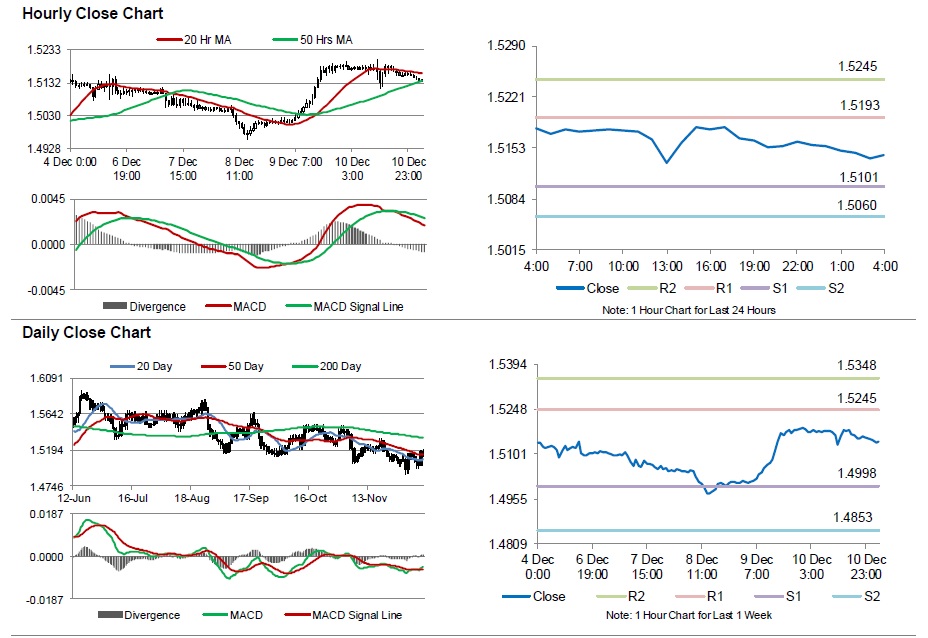

In the Asian session, at GMT0400, the pair is trading at 1.5142, with the GBP trading 0.1% lower from yesterday’s close.

The pair is expected to find support at 1.5101, and a fall through could take it to the next support level of 1.5060. The pair is expected to find its first resistance at 1.5193, and a rise through could take it to the next resistance level of 1.5245.

Going ahead, investors will look forward to UK’s construction output and consumer inflation expectations data, scheduled to be released in a few hours.

The currency pair is trading below its 20 Hr moving average and is showing convergence with its 50 Hr moving average.