For the 24 hours to 23:00 GMT, the GBP declined 0.39% against the USD and closed at 1.4105, after the Bank of England (BoE) reiterated that any future interest rate hikes would be gradual and limited.

The BoE, at its March monetary policy meeting, opted to keep the benchmark interest rate steady at 0.50% and its asset purchase facility at £435.0 billion, with two officials surprisingly voting for an immediate rate hike. The minutes of the meeting revealed that policymakers expressed the need for further gradual monetary policy tightening in order to bring inflation back to the central bank’s 2.00% target. Further, the central bank warned that an increase in protectionism could have a “significant negative impact” on global growth and could stoke inflation.

On the macro front, UK’s retail sales rose 0.8% on a monthly basis in February, topping market expectations for an advance of 0.4%. Retail sales had recorded a rise of 0.1% in the previous month.

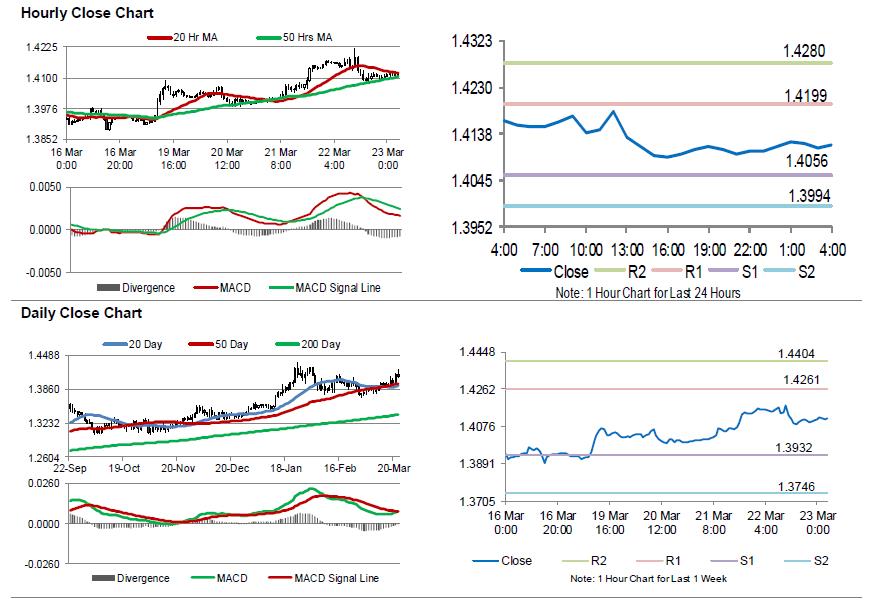

In the Asian session, at GMT0400, the pair is trading at 1.4117, with the GBP trading 0.09% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.4056, and a fall through could take it to the next support level of 1.3994. The pair is expected to find its first resistance at 1.4199, and a rise through could take it to the next resistance level of 1.4280.

With no macroeconomic releases in UK today, investors would await the release of UK’s final 4Q GDP numbers, GfK consumer confidence index, mortgage approvals and net consumer credit data, all slated to release next week.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.