For the 24 hours to 23:00 GMT, the GBP declined 0.55% against the USD and closed at 1.3011, as Brexit worries outweighed Bank of England’s rate view.

On the macro front, UK’s retail sales unexpectedly fell 0.6% on a monthly basis in November, marking its biggest fall this year and compared to a revised flat reading in the prior month.

The Bank of England (BoE), in its latest monetary policy meeting, opted to leave its key interest rate steady at 0.75% by a majority vote of 7-2, as policymakers focus on the upcoming Brexit deadline. The central bank projected further sluggish growth in inflation remaining below its target levels till mid-2021. The officials downgraded thier growth projection for the fourth quarter to 0.1% from 0.2%. The minutes of the monetary policy meeting showed that the members believe that the policy would require limited gradual tightening to maintain inflation sustainably at the 2% target.

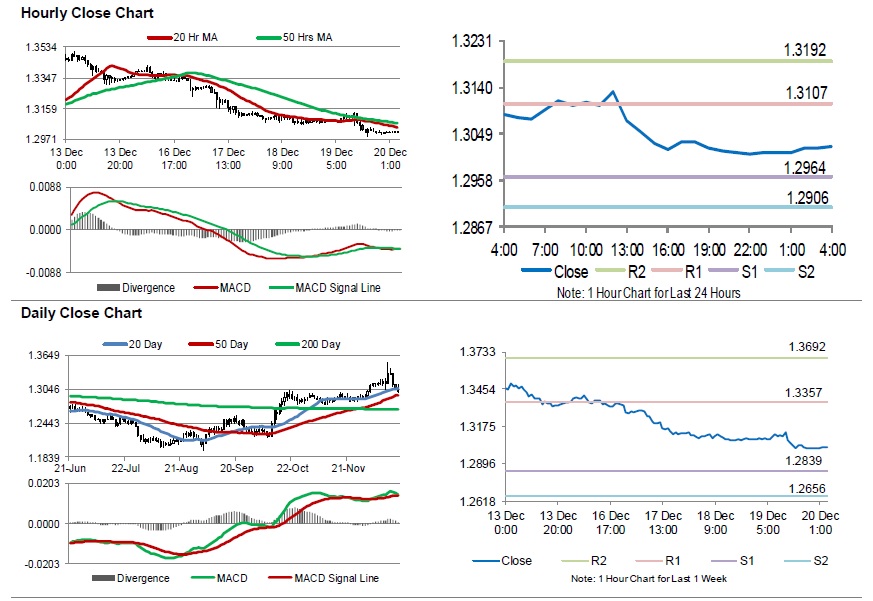

In the Asian session, at GMT0400, the pair is trading at 1.3023, with the GBP trading 0.09% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2964, and a fall through could take it to the next support level of 1.2906. The pair is expected to find its first resistance at 1.3107, and a rise through could take it to the next resistance level of 1.3192.

Moving ahead, traders would await UK’s gross domestic product for 3Q 2019 and public sector net borrowing for November, set to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.