For the 24 hours to 23:00 GMT, the GBP fell 2.12% against the USD and closed at a new 31-year low of 1.2994, amid renewed Brexit worries and after the release of downbeat UK services data.

Yesterday, UK’s Markit services PMI dropped more-than-expected to a level of 52.3 in June, its weakest in over three years, as growth in the nation’s services sector was hit in the run-up to the Brexit referendum. The services PMI had registered a reading of 53.5 in the previous month.

Separately, the Bank of England (BoE), in its bi-annual assessment of financial stability report, warned that the outlook for UK’s financial stability post-Brexit was “challenging” and that UK will take time to establish new relationships with the European Union and the rest of the world. The central bank also unveiled new steps to ensure that British banks keep on lending, by lowering the amount of capital banks must hold in reserve and released as much as £150 billion worth of lending to British households and businesses. Further, the BoE Governor, Mark Carney, assured markets that the central bank has a plan that is working and that it stands ready to take any further actions, if needed.

In the Asian session, at GMT0300, the pair is trading at 1.2872, with the GBP trading 0.94% lower against the USD from yesterday’s close.

Overnight data showed that UK’s BRC shop price index dropped further by 2.0% YoY in June, following a decline of 1.8% in the previous month.

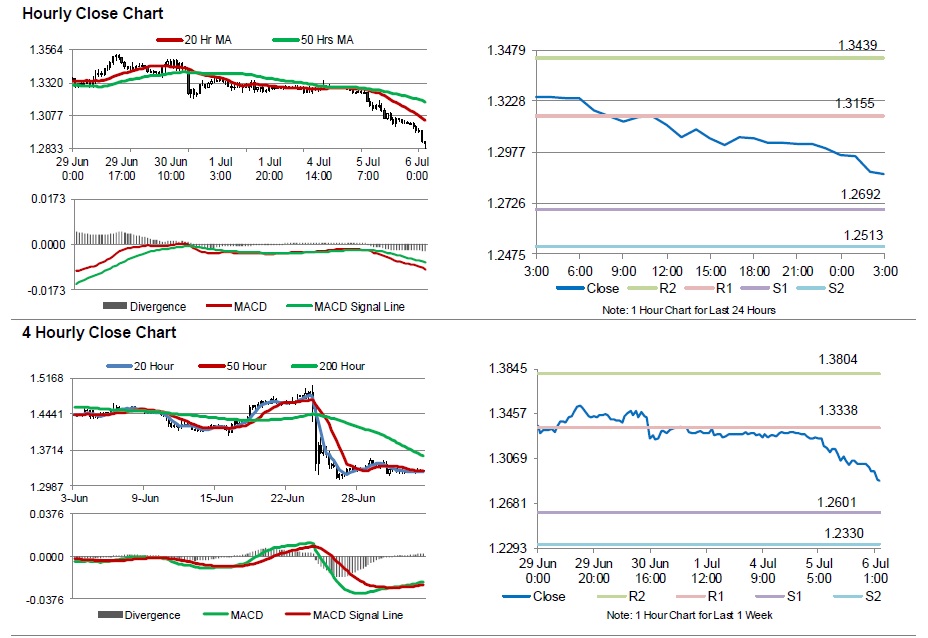

The pair is expected to find support at 1.2692, and a fall through could take it to the next support level of 1.2513. The pair is expected to find its first resistance at 1.3155, and a rise through could take it to the next resistance level of 1.3439.

With no major economic releases in Britain today, investors will look forward to the nation’s industrial production and manufacturing production data, both for the month of May, along with the NIESR GDP estimate data for the three months ended June, all due tomorrow.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.