For the 24 hours to 23:00 GMT, the GBP rose 0.79% against the USD and closed at 1.2819.

Yesterday, the Bank of England, in its bi-annual Financial Stability Report, warned of possible threats of a “hard Brexit” on the UK economy and has called British banks to increase their capital requirements to prepare for the uncertain outcome of Brexit talks.

In the Asian session, at GMT0300, the pair is trading at 1.2818, with the GBP trading marginally lower against the USD from yesterday’s close.

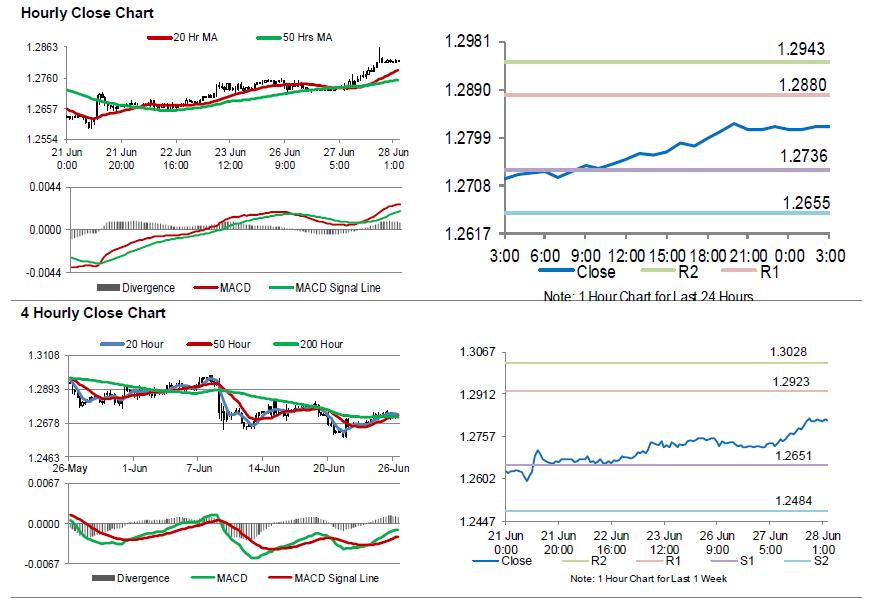

The pair is expected to find support at 1.2736, and a fall through could take it to the next support level of 1.2655. The pair is expected to find its first resistance at 1.288, and a rise through could take it to the next resistance level of 1.2943.

Moving ahead, investors will look forward to the UK’s nationwide house prices data, slated to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.