For the 24 hours to 23:00 GMT, GBP rose 0.98% against the USD and closed at 1.6609, after the Bank of England (BoE), in its quarterly inflation report, raised its growth-forecast on Britain’s economy and hinted that the interest rates in the nation could start to rise from record lows in little more than a year. The report also projected inflation and the unemployment rate in the nation to gradually ease in the near future. However, gains in the UK Sterling were slightly capped after the BoE Governor, Mark Carney, opined that a stronger Pound could add to the challenges of the UK’s export sector.

On the economic front, the CB leading economic index in the UK fell 0.1% to a reading of 108.2 in December, following a 0.5% increase registered in the preceding month.

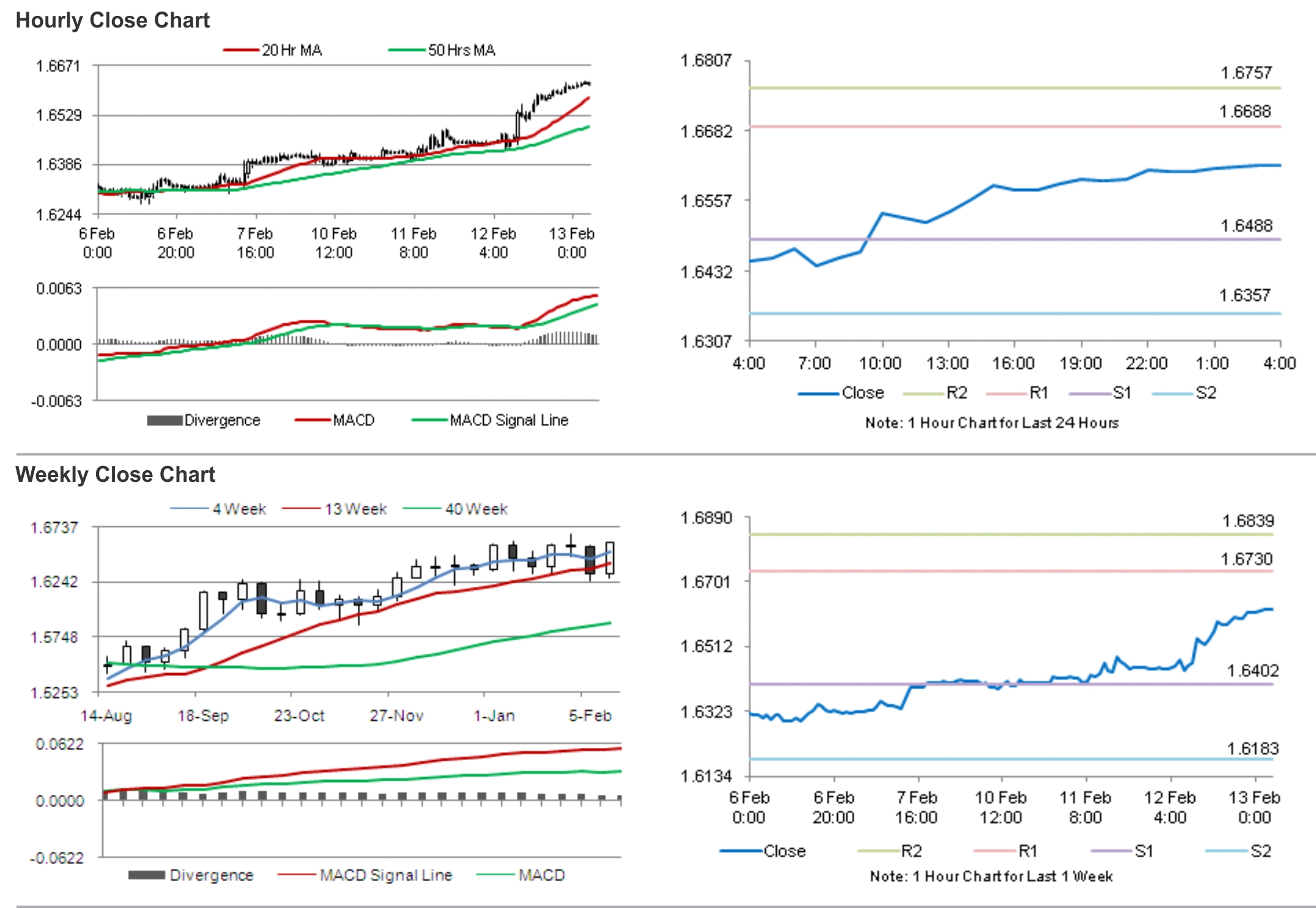

In the Asian session, at GMT0400, the pair is trading at 1.6620, with the GBP trading 0.07% higher from yesterday’s close.

Early morning, data showed that the RICS housing price balance in the UK unexpectedly fell to a level of 53.0% in January, from previous month’s level of 56.0%.

The pair is expected to find support at 1.6488, and a fall through could take it to the next support level of 1.6357. The pair is expected to find its first resistance at 1.6688, and a rise through could take it to the next resistance level of 1.6757.

Amid lack of economic releases from the UK during the latter course of the day, traders are expected to keep a close tab on global economic news for further guidance in the pair.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.