For the 24 hours to 23:00 GMT, the GBP rose 0.18% against the USD and closed at 1.2511.

Yesterday, the Bank of England, in its financial stability report, stated that outlook for UK’s financial stability “remains challenging” following the Brexit vote and warned that a disorderly Brexit would have damaging effects on the financial system and the broader economy. It further warned that the US election outcome has “reinforced existing vulnerabilities” in UK’s financial system.

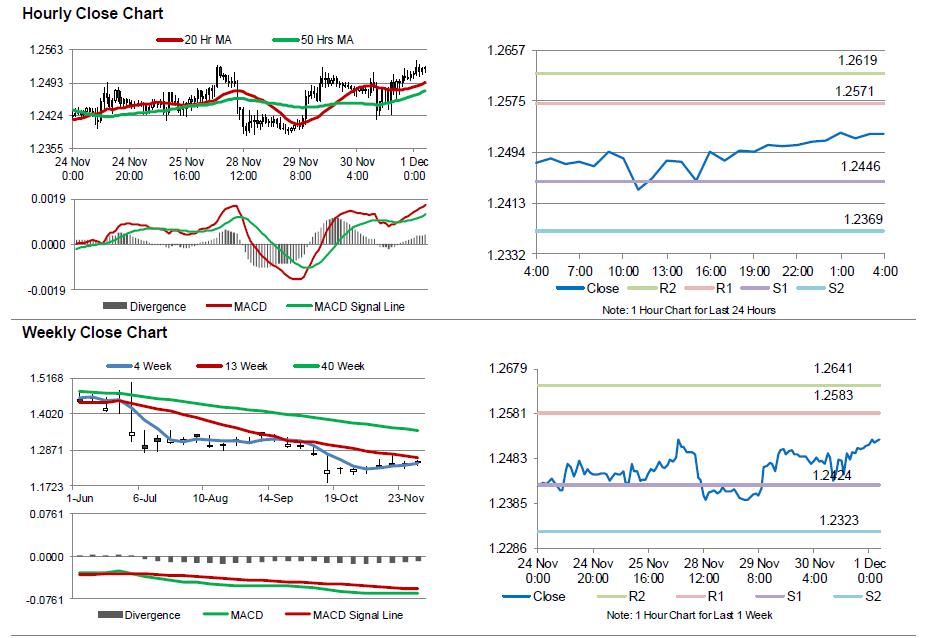

In the Asian session, at GMT0400, the pair is trading at 1.2524, with the GBP trading 0.1% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2446, and a fall through could take it to the next support level of 1.2369. The pair is expected to find its first resistance at 1.2571, and a rise through could take it to the next resistance level of 1.2619.

Ahead in the day, market participants would closely monitor UK’s Markit manufacturing PMI for November.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.