For the 24 hours to 23:00 GMT, the GBP declined 1.45% against the USD and closed at 1.3079 on Friday, after British Prime Minister, Theresa May, stated that the UK and European Union (EU) have reached an impasse in Brexit negotiations and warned that the UK must be prepared for leaving the EU without a deal.

In the economic news, UK’s public sector net borrowing posted a deficit of £5.9 billion in August, more than market expectations for a deficit of £2.9 billion. In the prior month, the nation had recorded a revised surplus of £3.9 billion.

In the Asian session, at GMT0300, the pair is trading at 1.3078, with the GBP trading slightly lower against the USD from Friday’s close.

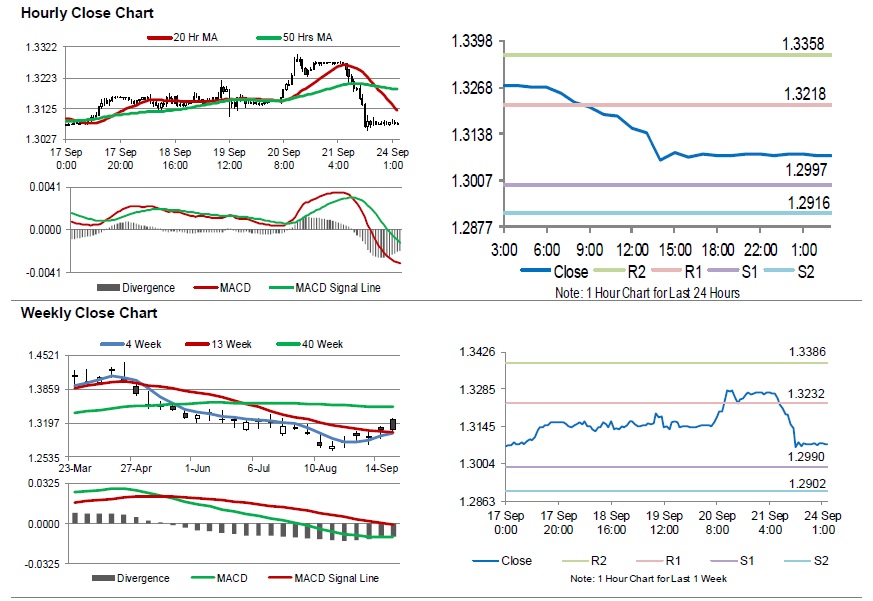

The pair is expected to find support at 1.2997, and a fall through could take it to the next support level of 1.2916. The pair is expected to find its first resistance at 1.3218, and a rise through could take it to the next resistance level of 1.3358.

Trading trend in the Sterling today is expected to be determined by UK’s CBI total trends orders for September, scheduled to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.