For the 24 hours to 23:00 GMT, the GBP rose 0.15% against the USD and closed at 1.4830, following upbeat 4Q GDP figures in the UK.

Britain’s GDP unexpectedly grew 0.6% on a quarterly basis in 4Q 2014, higher than market expected expansion of 0.5% and following a similar rise registered in the prior quarter.

Other economic data showed that UK’s current account deficit narrowed to £25.3 billion in the final quarter of 2014, compared to a revised deficit of £27.7 billion in the previous quarter. Market expectations were for the country’s current account deficit to narrow to £22.0 billion.

In the Asian session, at GMT0300, the pair is trading at 1.4865, with the GBP trading 0.24% higher from yesterday’s close.

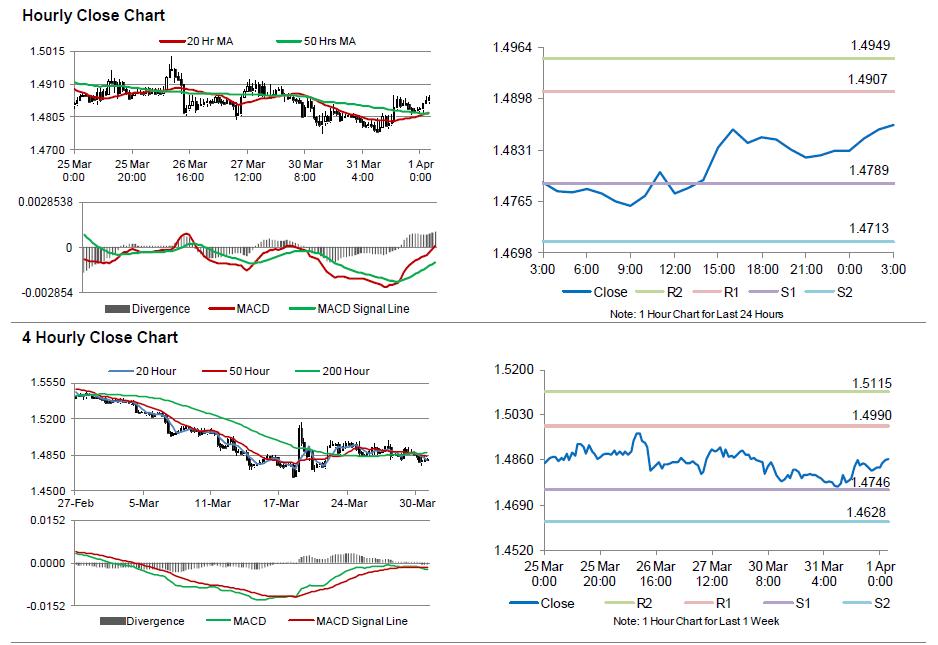

The pair is expected to find support at 1.4789, and a fall through could take it to the next support level of 1.4713. The pair is expected to find its first resistance at 1.4907, and a rise through could take it to the next resistance level of 1.4949.

Going forward, investors would keep a close eye on UK’s manufacturing PMI reading, scheduled in few hours for further direction.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.