For the 24 hours to 23:00 GMT, the GBP rose 0.30% against the USD and closed at 1.5646, after UK’s May consumer prices ticked higher on an annual basis in May.

Data showed that Britain’s consumer price inflation rebounded 0.1% on an annual basis in May, following a brief period of falling prices. In the previous month, consumer prices had dipped 0.1%

In the Asian session, at GMT0300, the pair is trading at 1.5643, with the GBP trading 0.02% lower from yesterday’s close.

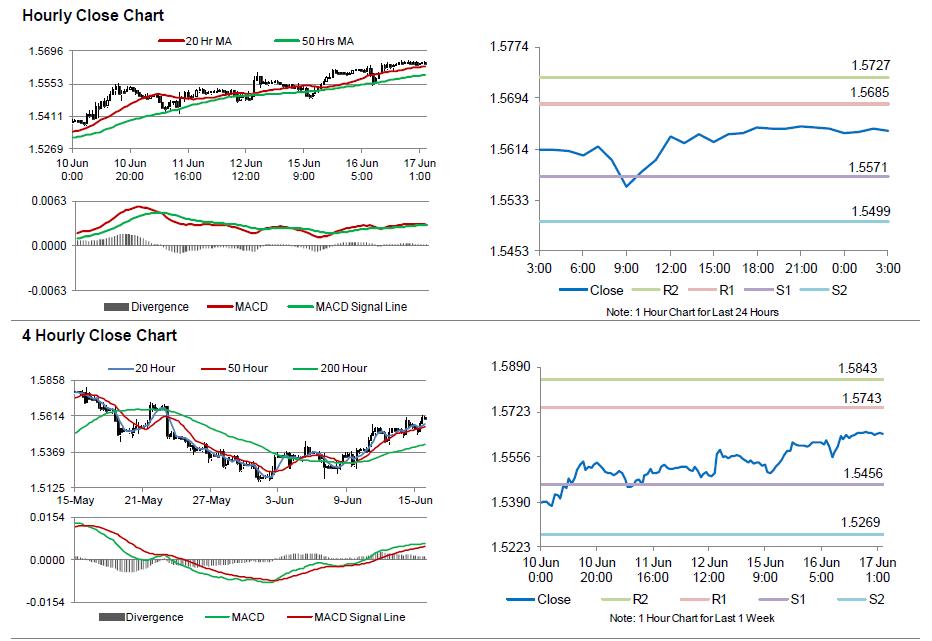

The pair is expected to find support at 1.5571, and a fall through could take it to the next support level of 1.5499. The pair is expected to find its first resistance at 1.5685, and a rise through could take it to the next resistance level of 1.5727.

Moving ahead, investors would keep a close eye on the UK’s employment data as well as the BoE minutes from its recent monetary policy meeting, scheduled in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.