For the 24 hours to 23:00 GMT, the GBP declined 1.64% against the USD and closed at 1.2814.

On the data front, UK’s industrial production unexpectedly declined 0.1% on a monthly basis in January, confounding market forecast for a rise of 0.3% and compared to a rise of 0.1% in the previous month. Additionally, total trade surplus narrowed to £4.2 billion in January, compared to a revised surplus of £6.3 billion in the prior month. Moreover, gross domestic product (GDP) recorded a flat reading on a monthly basis in January, compared to a rise of 0.3% in the previous month. Meanwhile, manufacturing production rose 0.2% on a monthly basis in January, in line with market expectations and compared to rise of 0.3% in the prior month. Furthermore, the NIESR GDP estimate rose 0.2% in the three months to February, compared to a flat reading in the prior month.

The Bank of England (BoE), in its interest rate decision, slashed its key interest rate by 50bps to 0.25% from 0.75%, unanimously and warned that the coronavirus would bring a “sharp and large shock” to Britain’s economy. Additionally, the central bank warned that economic activity “is likely to weaken materially” in the UK over the coming months. Meanwhile, the bank announced a new term-funding scheme to support small and medium-sized companies. Separately, the BoE Governor, Mark Carney, stated that the central bank is prepared to take additional measures to combat the economic impact of the coronavirus outbreak.

In the Asian session, at GMT0400, the pair is trading at 1.2824, with the GBP trading 0.08% higher against the USD from yesterday’s close.

Overnight data indicated that the RICS housing price balance increased to 29.0% in February, compared to revised gain of 18.0% in the previous month.

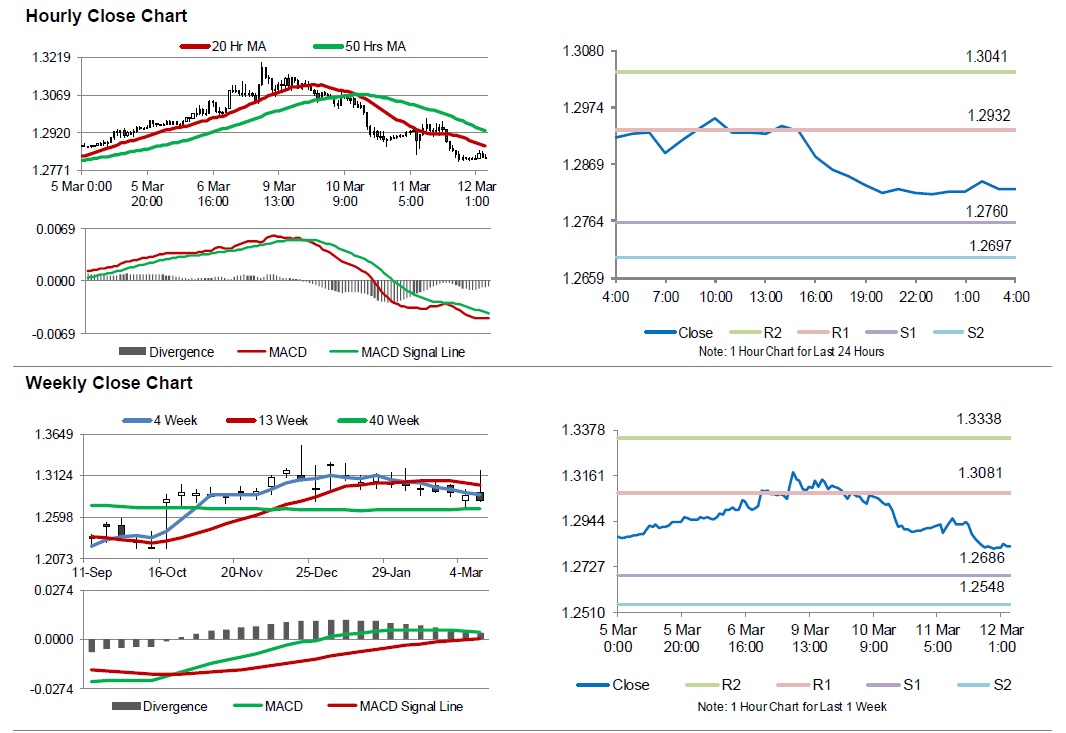

The pair is expected to find support at 1.2760, and a fall through could take it to the next support level of 1.2697. The pair is expected to find its first resistance at 1.2932, and a rise through could take it to the next resistance level of 1.3041.

Amid no major macroeconomic releases in the UK today, investor sentiment would be determined by global macroeconomic factors.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.