For the 24 hours to 23:00 GMT, the GBP declined 0.31% against the USD and closed at 1.3035 on Friday.

Macroeconomic data showed that UK’s final gross domestic product (GDP) advanced 0.4% on a quarterly basis in 2Q 2018, in line with market expectations and confirming the preliminary print. In the prior quarter, the GDP registered a rise of 0.2%.

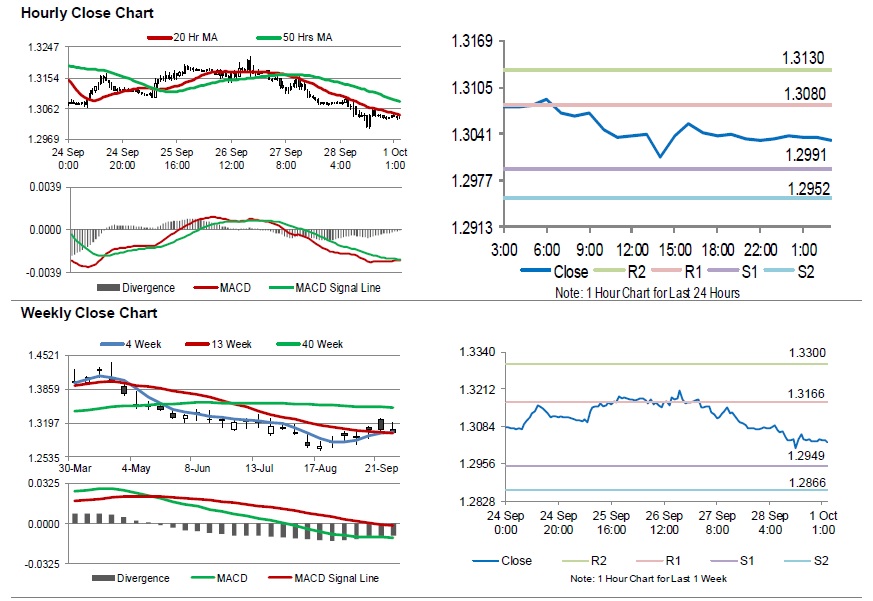

In the Asian session, at GMT0300, the pair is trading at 1.3031, with the GBP trading slightly lower against the USD from Friday’s close.

The pair is expected to find support at 1.2991, and a fall through could take it to the next support level of 1.2952. The pair is expected to find its first resistance at 1.3080, and a rise through could take it to the next resistance level of 1.3130.

Moving forward, investors would await the UK’s net consumer credit and mortgage approvals, both for August and the Markit manufacturing PMI for September, slated to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.