For the 24 hours to 23:00 GMT, the GBP rose 0.80% against the USD and closed at 1.3028, after the European Union’s Chief Brexit Negotiator, Michel Barnier raised hopes for a smooth Brexit with an ‘realistic’ departure agreement in the next 6 to 8 weeks.

On the macro data front, the nation’s gross domestic product (GDP) advanced 0.3% on monthly basis in July, surpassing market expectations for a rise of 0.2%. In the previous month, the GDP had recorded a reading of 0.1%. Additionally, the nation’s total trade deficit unexpectedly narrowed to £0.11 billion in July, following a revised deficit of £0.94 billion in the previous month. Market participants had anticipated to report a deficit of £2.10 billion. Further, industrial production climbed 0.9% on a yearly basis in July, compared to a rise of 1.1% in the previous month. Market participants had expected the industrial production to climb 1.1%. Moreover, manufacturing production advanced 1.1% on an annual basis in July, less than market expectations for a gain of 1.4%. In the previous month, manufacturing production had registered a rise of 1.5%. Meanwhile UK’s construction output climbed 3.5% on an annual basis in July, compared to a rise of 2.2% in the previous month. Market participants had envisaged construction output to increase 2.6%.

In the Asian session, at GMT0300, the pair is trading at 1.3034, with the GBP trading 0.05% higher against the USD from yesterday’s close.

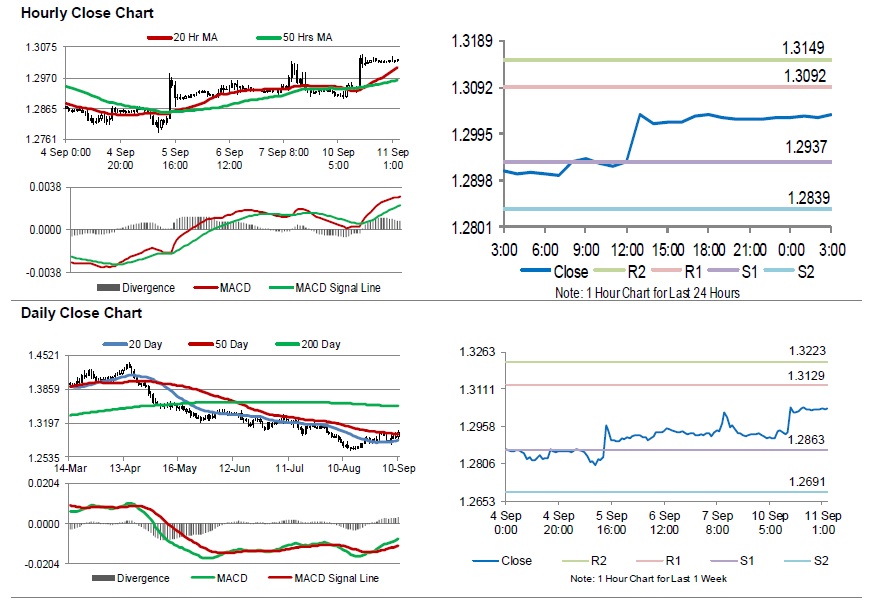

The pair is expected to find support at 1.2937, and a fall through could take it to the next support level of 1.2839. The pair is expected to find its first resistance at 1.3092, and a rise through could take it to the next resistance level of 1.3149.

Going ahead, traders would await UK’s ILO unemployment rate and average weekly earnings, both for July, due to be released in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.