For the 24 hours to 23:00 GMT, the GBP rose 0.10% against the USD and closed at 1.2571.

On the data front, UK’s gross domestic product climbed 1.8% on a monthly basis in May, less than market forecast for a rise of 5.0% and compared to a revised plunge of 20.3% in the prior month. Meanwhile, industrial production climbed 6.0% on a monthly basis in May, in line with market expectations and compared to a revised drop of 20.2% in the earlier month. Additionally, manufacturing production jumped 8.4% on a monthly basis in May, more than market forecast and compared to a revised drop of 24.4% in the previous month. Further, total trade surplus widened to £4.3 billion in May, compared to a revised surplus of £2.3 billion in the prior month.

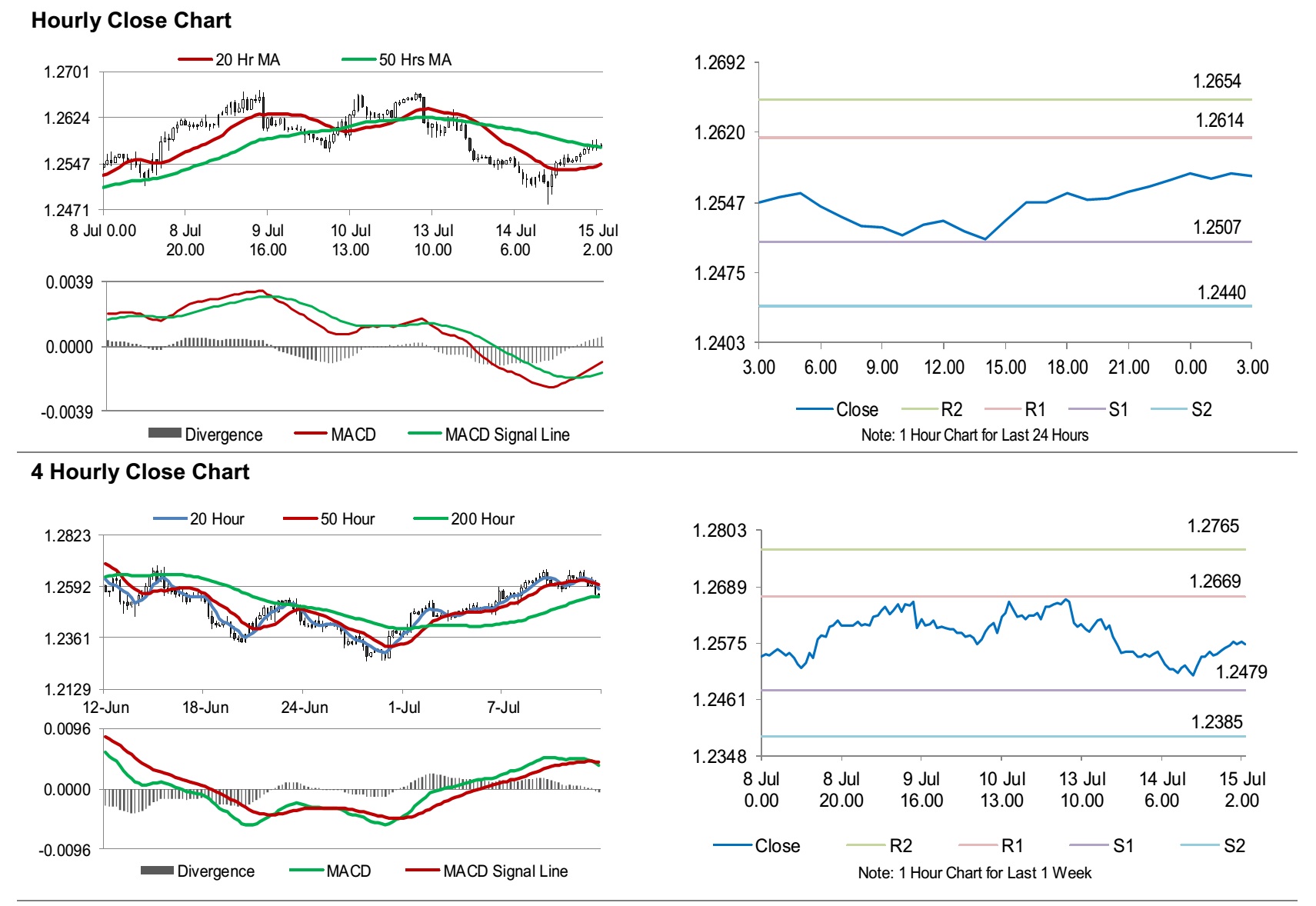

In the Asian session, at GMT0300, the pair is trading at 1.2574, with the GBP trading marginally higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2507, and a fall through could take it to the next support level of 1.2440. The pair is expected to find its first resistance at 1.2614, and a rise through could take it to the next resistance level of 1.2654.

Going ahead, traders would keep a watch on UK’s consumer price index, retail price index, and the producer price index, all for June, along with the DCLG house price index for May, slated to release in a few hours.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.