For the 24 hours to 23:00 GMT, the GBP declined 1.26% against the USD and closed at 1.3077, after Britain’s parliament rejected Prime Minister Theresa May’s Brexit deal for a second time in a vote, increasing the likelihood of a no-deal scenario.

On the data front, UK’s total trade deficit widened to £3.83 billion in January, amid decline in automobile production and compared to a revised deficit of £3.45 billion in the previous month. Market participants had expected the nation to post a deficit of £3.50 billion. Further, the nation’s industrial production fell 0.9% on an annual basis in January, less than market expectations for a fall of 1.3%. Industrial production had registered a similar drop in the previous month. Also, UK’s manufacturing production declined 1.1% on a yearly basis in January, less than market consensus for a fall of 1.9%. In the prior month, manufacturing production had recorded a fall of 2.1%.

On the flipside, Britain’s gross domestic product (GDP) rebounded 0.5% on a monthly basis in January, surpassing market consensus for a rise of 0.2%. The GDP had recorded a decline of 0.4% in the previous month. Moreover, the nation’s construction output unexpectedly advanced 1.8% in January, defying market expectations for a fall of 0.2%. In the prior month, construction output had registered a fall of 2.4%.

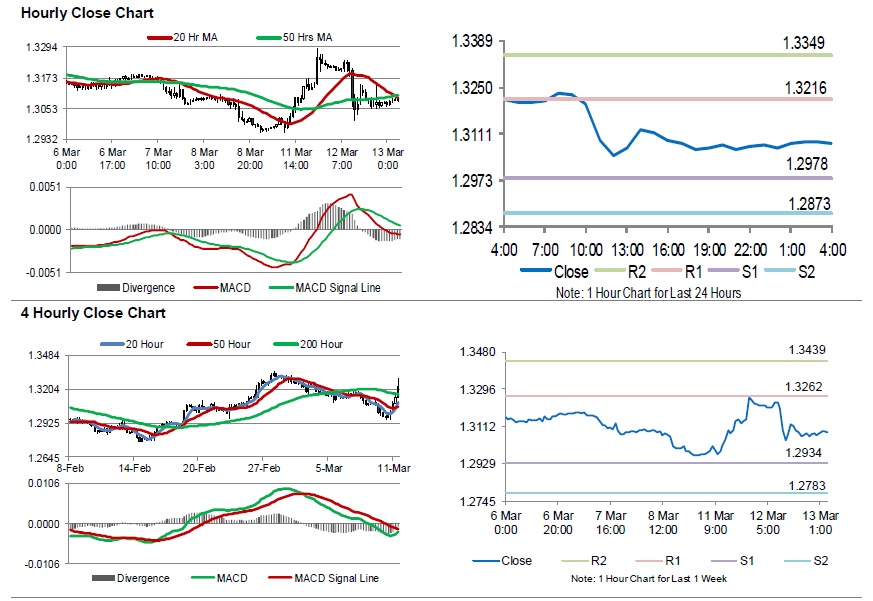

In the Asian session, at GMT0400, the pair is trading at 1.3084, with the GBP trading 0.05% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2978, and a fall through could take it to the next support level of 1.2873. The pair is expected to find its first resistance at 1.3216, and a rise through could take it to the next resistance level of 1.3349.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.