For the 24 hours to 23:00 GMT, the GBP rose 0.70% against the USD and closed at 1.2845 on Friday, amid reports of a possible delay in Brexit vote.

Macroeconomic data indicated that UK’s gross domestic product slowed to a six-month low level of 0.3% in the three-months ended November, dragged down by uncertainty over global trade and Brexit and in line with market consensus. The GDP had advanced 0.4% in the three-months ended October. Additionally, the nation’s total trade deficit narrowed to £2.9 billion in November, compared to a revised deficit of £3.0 billion in the previous month. Market participants had expected the nation to record a deficit of £2.8 billion. Furthermore, Britain’s industrial production dropped 1.5% on an annual basis in November, higher than market consensus for a fall of 0.7%. In the preceding month, industrial production had recorded a revised decline of 0.9%. Moreover, manufacturing production unexpectedly eased 0.3% on a monthly basis in November, defying market expectations for an advance of 0.4%. Manufacturing production had registered a revised drop of 0.6% in the previous month.

Meanwhile, construction output rebounded 0.6% on a monthly basis in November, beating market expectations for a rise of 0.2% and compared to a drop of 0.2% in the previous month.

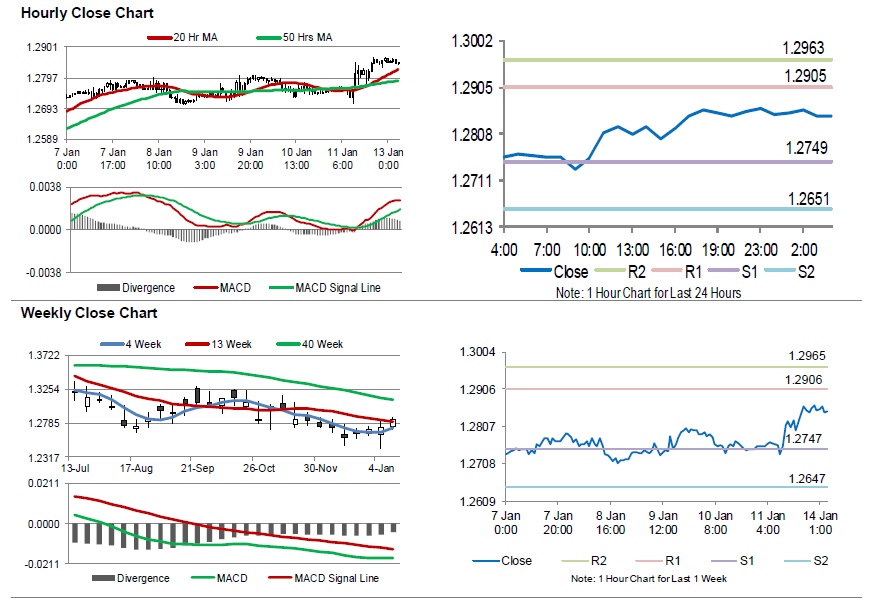

In the Asian session, at GMT0400, the pair is trading at 1.2846, with the GBP trading a tad higher against the USD from Friday’s close.

The pair is expected to find support at 1.2749, and a fall through could take it to the next support level of 1.2651. The pair is expected to find its first resistance at 1.2905, and a rise through could take it to the next resistance level of 1.2963.

Amid lack of economic releases in UK today, traders would focus on global macroeconomic events for further direction.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.