For the 24 hours to 23:00 GMT, the GBP rose 0.08% against the USD and closed at 1.3154, amid renewed hopes for a Brexit deal.

On the macro front, UK’s gross domestic product (GDP) remained flat on a monthly basis in August, compared to a growth of 0.4% in the prior month. Market participants had envisaged the GDP to rise 0.1%. Britain’s industrial production advanced 1.3% on a yearly basis in August, beating market expectations for a gain of 1.0%. In the preceding month, industrial production had recorded a revised rise of 1.0%. Additionally, manufacturing production rose 1.3% on a yearly basis in August, surpassing market forecast for a gain of 1.1%. In the prior month, manufacturing production had recorded a revised rise of 1.4%. Meanwhile, the nation’s total trade deficit widened more than expected to £1.27 billion in August, compared to a revised deficit of £0.57 billion in the previous month. Markets had expected the nation to post a deficit of £1.20 billion.

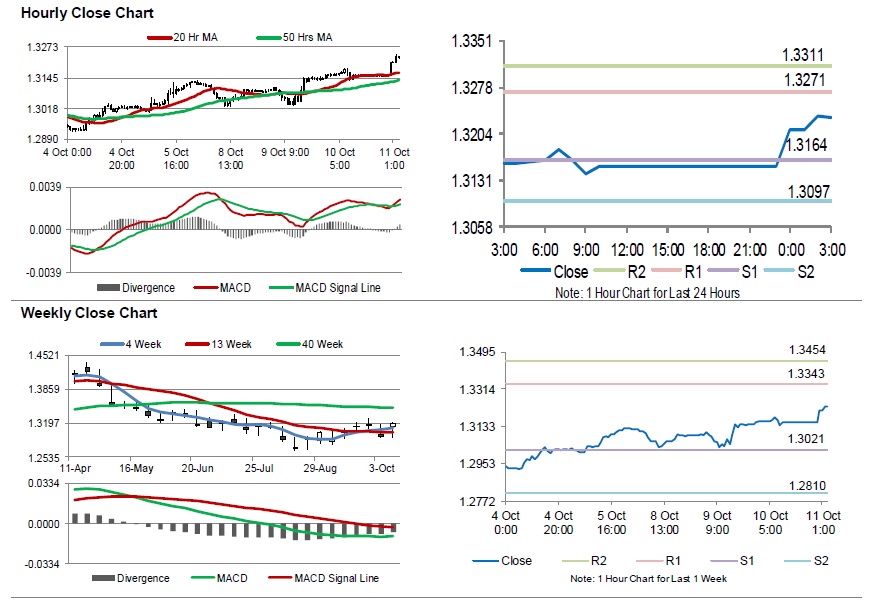

In the Asian session, at GMT0300, the pair is trading at 1.3231, with the GBP trading 0.59% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.3164, and a fall through could take it to the next support level of 1.3097. The pair is expected to find its first resistance at 1.3271, and a rise through could take it to the next resistance level of 1.3311.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.