For the 24 hours to 23:00 GMT, the GBP rose 0.53% against the USD and closed at 1.4129.

In economic news, UK’s manufacturing production declined more-than-expected by 1.1% MoM in February, raising fears over the performance of the nation’s economy. Investors had expected it to fall by 0.2%, following a rise of 0.5% in the previous month. Additionally, the nation’s industrial production surprisingly dropped by 0.3% in February, compared to a revised advance of 0.2% in the prior month. Markets were anticipating industrial production to climb 0.1%. Moreover, Britain’s total trade deficit dropped to £4.84 billion, compared to market expectations for a total trade deficit of £3.4billion and after reporting a revised total trade deficit of £5.2 billion in the prior month. Separately, the NIESR estimated gross domestic product (GDP) in the UK registered a rise of 0.3% in the January-March 2016. In the December-February 2016 period, NIESR estimated GDP had climbed by a downwardly revised 0.2%.

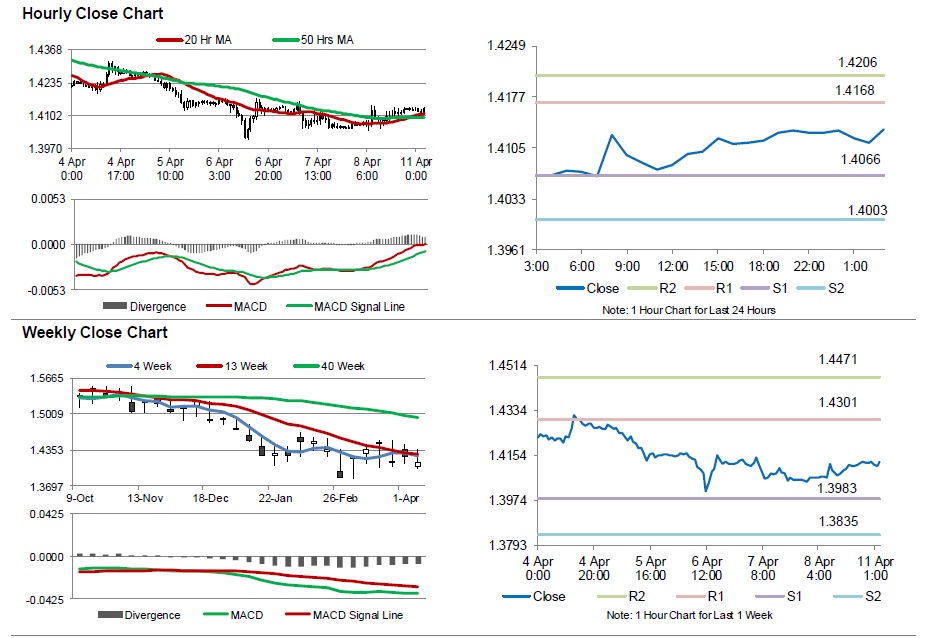

In the Asian session, at GMT0300, the pair is trading at 1.413, with the GBP trading marginally higher from Friday’s close.

The pair is expected to find support at 1.4066, and a fall through could take it to the next support level of 1.4003. The pair is expected to find its first resistance at 1.4168, and a rise through could take it to the next resistance level of 1.4206.

Going ahead, investors will look forward to UK’s consumer price index data for March, scheduled to release tomorrow.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.