For the 24 hours to 23:00 GMT, the GBP rose 0.18% against the USD and closed at 1.3333 on Friday.

On the macro front, data revealed that UK’s BBA mortgage approvals declined to a level of 40.49K in October, dropping to its lowest level since September 2016. Markets were anticipating mortgage approvals to drop to a level of 40.65K, after recording a revised reading of 41.58K in the previous month.

Meanwhile, the European Union (EU) handed the UK Prime Minister, Theresa May, a 10-day deadline to improve her Brexit divorce bill in order to start further negotiations on a transition period.

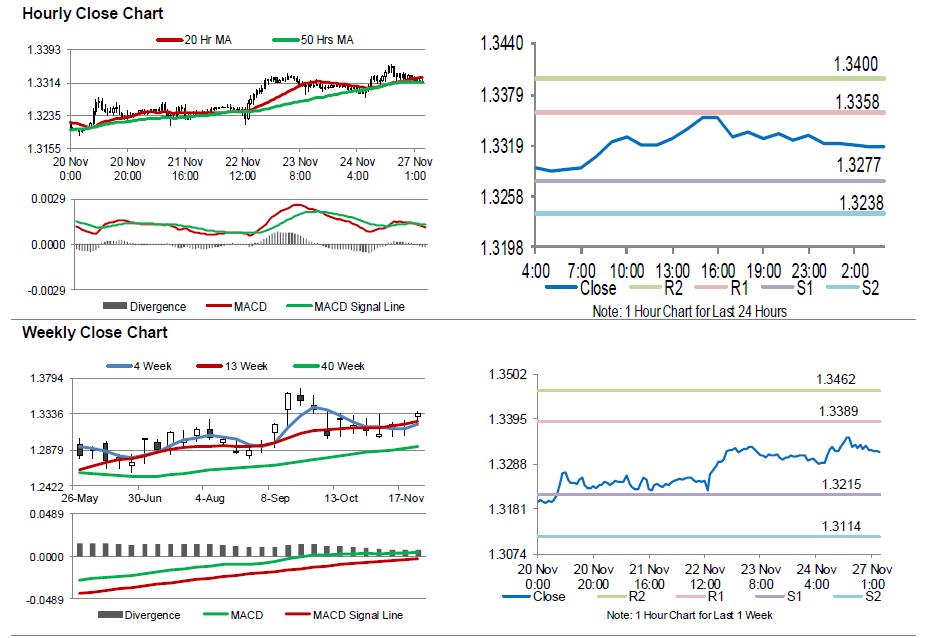

In the Asian session, at GMT0400, the pair is trading at 1.3317, with the GBP trading 0.12% lower against the USD from Friday’s close.

The pair is expected to find support at 1.3277, and a fall through could take it to the next support level of 1.3238. The pair is expected to find its first resistance at 1.3358, and a rise through could take it to the next resistance level of 1.3400.

In the absence of any major economic releases in the UK today, investor sentiment would be governed by global macroeconomic factors.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.