For the 24 hours to 23:00 GMT, the GBP slightly rose against the USD and closed at 1.3239.

On the macro front, UK’s public sector net borrowing posted a deficit of £7.5 billion in October, higher than market expectations for a deficit of £6.5 billion. Public sector net borrowing had recorded a revised deficit of £4.4 billion in the previous month. Moreover, the nation’s CBI industrial trends total orders sharply jumped to a level of 17.0 in November, hitting its highest level since August 1988. Industrial trends total orders had recorded a level of -2.0 in the prior month, while investors had envisaged for a rise to a level of 3.0.

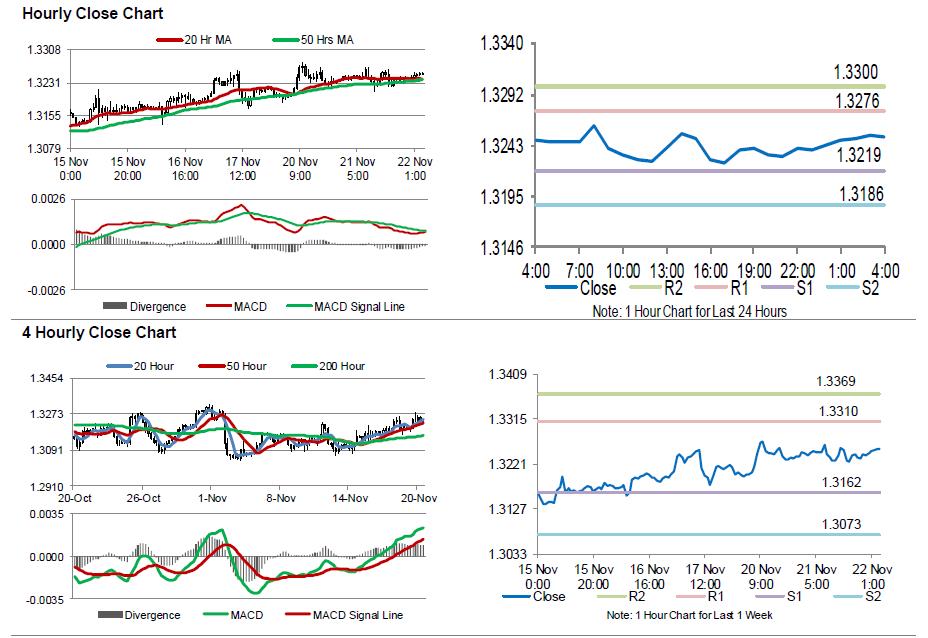

In the Asian session, at GMT0400, the pair is trading at 1.3252, with the GBP trading 0.1% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.3219, and a fall through could take it to the next support level of 1.3186. The pair is expected to find its first resistance at 1.3276, and a rise through could take it to the next resistance level of 1.3300.

Going ahead, traders would look forward to UK’s Autumn Budget, due in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.