For the 24 hours to 23:00 GMT, GBP rose 0.66 % against the USD and closed at 1.5431, as investors appetite for riskier currency rose, shrugging off the surge in the unemployment rate in the UK.

The unemployment rate in the UK edged up to 8.4% for the three months ended November, following an unemployment rate of 8.1% registered in the three months to August. Also, the total number of unemployed people in the economy edged up to 2.68 million. The claimant count climbed by 1,200 to 1.60 million in December, while the claimant count rate remained unchanged at 5.0% in December.

In the Asian session, at GMT0400, the pair is trading at 1.5441, with the GBP trading 0.06% higher from yesterday’s close.

This morning, Nationwide Consumer Confidence Index in the UK declined to 38.0 in December, from 40.0 in November.

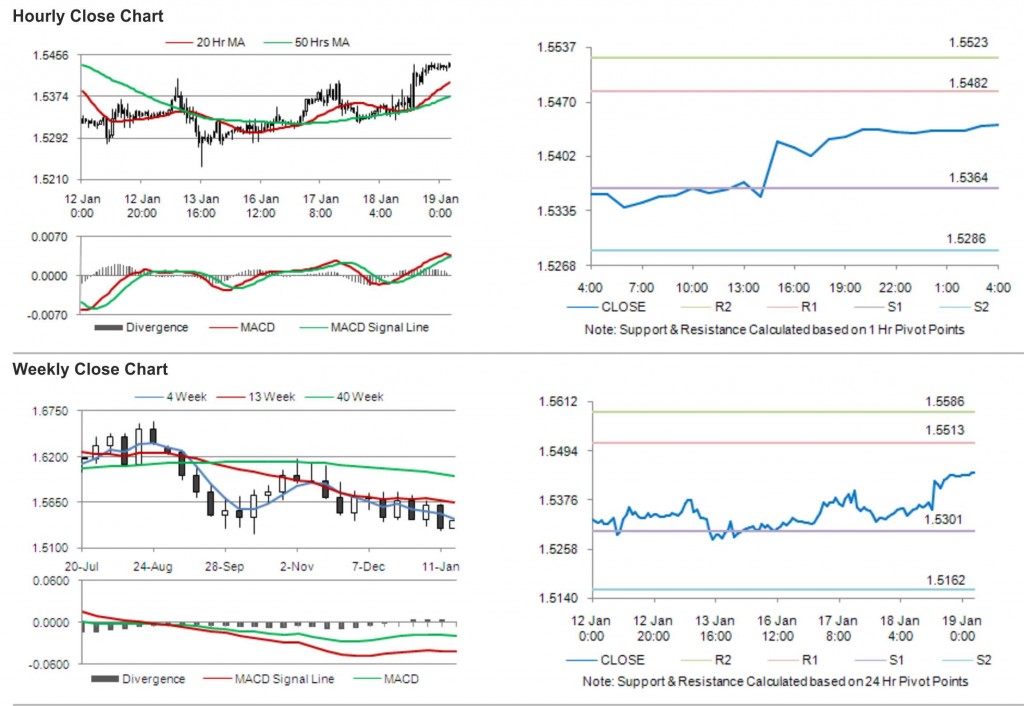

The pair is expected to find support at 1.5364, and a fall through could take it to the next support level of 1.5286. The pair is expected to find its first resistance at 1.5482, and a rise through could take it to the next resistance level of 1.5523.

The currency pair is trading well above its 20 Hr and its 50 Hr moving average.